Do You Remember?

Written by Paul Siluch

November 14th, 2023

Remember your first concert? It is a defining moment of adolescence. An experience of music deeply personal to you at an impressionable age.

Mine was seeing the band Chicago in 1976 in Edmonton. Right at their peak.

My mother liked musicals and was a Harry Belafonte fan, but life in Edmonton and then northern Saskatchewan did not offer much in the way of live concerts. My dad was more of a film score fellow. Play him the Dr. Zhivago soundtrack and put a glass of whiskey in his hand and he was blissful.

Music artists used to make most of their money from songs played on the radio, which led to the sales of records. Every sale made 9.1 cents, so a million-seller generated around $91,000 and a million sales of the full album maybe ten times that. Then add in royalties from the radio stations – about 6 cents per play to the artist. Played multiple times per day from 10,000 radio stations (my estimate based on 1950-2023 radio trends) meant a big hit single with over a million records sold could rake in $1 million dollars for the songwriter.

Today, most songs aren’t sold – they are streamed through a streaming service like Spotify. Spotify pays approximately $0.004 per stream.

- In 1965, a hit single could be worth upwards of $1,000,000 to the songwriter.

- In 2023, a hit single streamed ten million times generates just $40,000.

That’s a big haircut. Even for a rock star.

With royalties dropping through the floor, up to 80% of a performer’s income now comes from concerts and merchandise (source: AWAL), so it is no surprise to see many grey-haired artists shambling onstage and playing live. That’s where the money is now.

The Experience Economy

A concert is an experience, as opposed to a possession. Money spent on memories versus material things.

We used to be able to do both until these material things became so expensive. Now, today’s largest generation – the millennials, born between 1981 and 1996 – are forced to choose between experiences and possessions. It is reshaping the economy.

The Taylor Swift Effect is the most visible aspect of this experiences-over-possessions phenomenon. Ms. Swift is a young artist whose songs and lyrics capture the emotional angst of today’s generation, coupled with an astute business sense. Starting as an obscure country singer in 2006 at the age of just 16, she did what few others have done to this fossilized genre: she made it cool. The average age of a country fan is 45 and she introduced a whole new generation to it.

Over the next decade, Taylor Swift evolved herself into the biggest mainstream popstar in the world at age 33. A single concert can generate close to $93 million, and a full cross-country tour generates over $4 billion. Her record at the top of the music charts has surpassed every artist, including the Beatles, and she ranks with Michael Jackson and Madonna (in the 1980s) as the most influential musician in history.

Her revenues rival those of a small country and her concerts affect the economic fortunes of entire cities.

She doesn’t just take. Taylor Swift used her enormous influence to force Spotify, Apple Music, Amazon, and Google - the dominant music streamers – to pay all artists more fairly. She is also one of the most charitable pop icons in the world, which makes her fans love her even more.

Memories over Material Things

To put the Experience Economy in perspective, here is a comparison of the share price of Whirlpool with Live Nation. Whirlpool (in blue) makes dishwashers and appliances and epitomizes material things. Live Nation sells concert tickets and is an excellent standard bearer for spending on memories.

Since 2014, Whirlpool shares have returned 0% while Live Nation has returned 300%.

What is pushing Millennials to spend in the moment instead of the future?

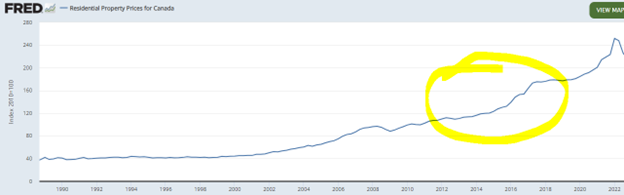

The previous generation, the Baby Boomers, bought homes as fast as they could. Houses were affordable until we started goosing prices higher. Canadian home prices accelerated when rates were slashed from 2000-2005 and again after 2009 when rates were cut again.

Prices really rocketed in 2016, sending prices to four times what they were just sixteen years earlier.

(source: Federal Reserve of St. Louis)

The Millennial generation was completely priced out of owning a home.

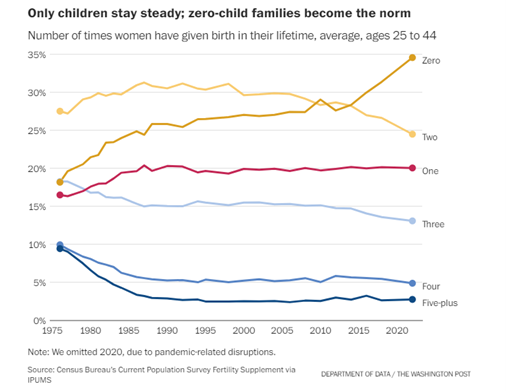

The other side effect is the declining birth rate. As the bird economist said, if you can’t afford a nest, why lay an egg?

Childless families are now the largest segment of U.S. births as birth rates plunged starting in 2015, just as home prices accelerated.

Pandemic Echoes

Four years ago, what were you doing? My guess is, roughly the same as you’d been doing for the previous ten years.

Then suddenly, the pandemic hit and the world shut down. Literally. We were told to lock our doors and mask up to stop the spread. Okay, I snuck out at 5 a.m. for early runs, but so did a few others. We looked away and stayed far apart.

As we approach 2024, most things have returned to normal, yet there are still side effects no one expected. Masks and hand sanitizers aren’t weird anymore. Work-from-home is an established right. We buy a test kit before we buy flu medication.

What couldn’t stop was time. So many events were postponed, people are desperate to catch up on everything they missed. Travel has surged in the last few years in a phenomenon called “revenge travel” as frustrated tourists double-booked trips to make up for lost time.

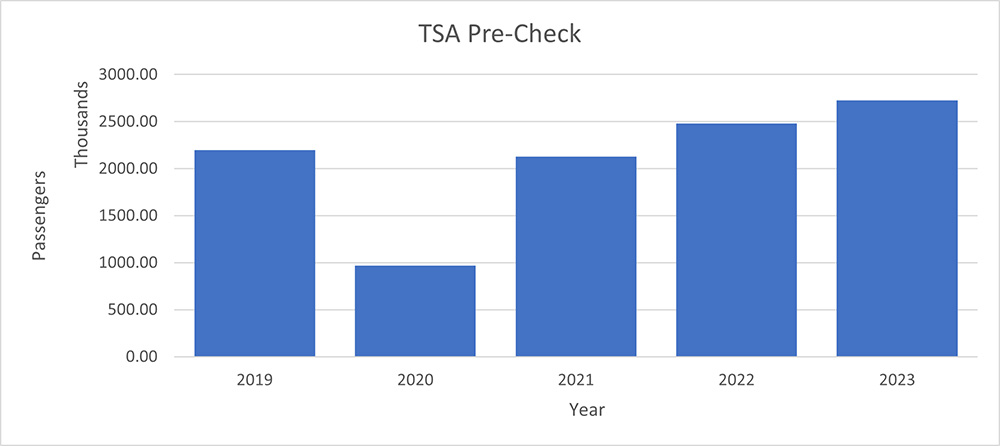

Here are the TSA pre-check numbers showing the number of people travelling through U.S. airports on a single day: September 1st – Labour Day.

(source: Transportation Security Administration daily check-in data)

Labour Day travel collapsed in 2020 but finally surpassed the 2019 high in 2022. 2023 is even higher at over 2.7 million travelers.

We have a screaming desire to get out and see the world. Some think this makes airlines a good investment. Warren Buffett once said that the world airline industry has lost more money than it has ever made going all the way back to the first flight of the Wright brothers at Kittyhawk in 1903. That’s a hundred years of ‘profitless prosperity.’

Airline stocks are good investments for short periods of time. But as we say in the business, date them, don’t marry them. They are not good investments now.

Experience Stocks

There is more to the Experience Economy than just concerts and travel. It can include gambling, theme parks, camping, and video games. And just because Taylor Swift gets $150-600 per ticket to see her perform live, it doesn’t mean every act does. Millennials may not be able to afford a home, but they still pay sky-high rents. Every dollar spent on experiences is a hard choice.

What this means is that societal trends, like this one, may not necessarily be investable trends.

Disney is a stock we own in portfolios, for example. It has suffered greatly in the last few years. The pandemic was obviously not good for theme parks, although attendance is returning. Disneyland is full again and sporting events - which Disney broadcasts through ESPN – are also full.

Disney can’t keep hiking entrance prices as they have in the past, and their movies peaked in attendance several years ago. The company will do fine in the years ahead, but even Disney is challenged.

Computer gaming is one sector that did benefit from the pandemic and hasn’t skipped a beat since. Nintendo is another stock we hold in our Dividend Value portfolio. It fits well into the Experience Economy theme because playing video games is an experience, even if you must buy the game and a machine to run it.

Nintendo is often overlooked by older gamers who played Super Mario and Pokémon as kids. But as their own children come of age, young parents appreciate the child-friendly themes of Nintendo and make the Switch the first game system for their young children.

Nintendo is also overlooked because it is headquartered in Japan, an investment backwater for the last 30 years.

Millions buy and play their games every year. Nintendo recently released an animated movie, "The Super Mario Bros. Movie," based on the plumber character Mario. Surprisingly, it made over $1.3 billion at the box office and became the 2nd highest-attended animated movie of all time. The movie’s success became self-reinforcing, spurring sales of Nintendo’s games and piquing interest in new releases.

We were attracted to Nintendo because of its much lower valuation and dividend. The movie’s success was both unexpected and a nice surprise. The key for the years ahead will be a new version of their Switch game console. That could spur millions in additional sales.

Meanwhile, Nintendo has announced another movie based on Legend of Zelda, another highly popular game, and plans to expand its theme park initiatives. It opened Super Nintendo World at Universal Studios Hollywood earlier this year, with two more theme parks already planned for Orlando and Singapore.

The stock rose 15% this week due to surging earnings. We are happy to see it finally perform and expect even more.

Family Helping Family

One of the biggest things we have been asked about in recent years is how to assist children.

One of the best ways is to help fund their tax-free savings accounts. Tax-free growth over many years is a gift that keeps on giving.

- In Canada, the TFSA, or Tax-Free Savings Account, is the vehicle of choice. Money invested grows tax-free and can be removed tax-free, as well. The annual contribution limit is rising from $6,500 to $7,000 in 2024.

- In the U.S., it is the Roth IRA. The Roth IRA limit is also rising from $6,500 to $7,000 in 2024. It has the same tax-free features as the TFSA.

- Canada introduced the First Home Savings Account, or FHSA this year. Up to $8,000 can be contributed for five years to create a downpayment on a new home. The money also grows tax-free. If your child has never owned a home, consider helping them with an FHSA.