Brave New World

Written by Paul Siluch

March 8th, 2024

The Silent generation was a small group compared to previous generations. Life was hard. They struggled for food and for jobs. Those who made up the Silents – those born between 1928 and 1945 – grew up in the shadow of the Depression and through the maelstrom of world war. Because of these trials, they came to prize stability and conformity.

Don’t make waves. Be dependable.

When WW2 ended, they did their duty by having babies, and lots of them. The Baby Boom generation, which was loosely defined as the period between 1946 and 1964 when an average of 4 million children were born every year, was the largest in history. Canada mirrored the U.S. experience with close to 400,000 babies born per year over that stretch.

I arrived at the tail end of this generation. We overwhelmed everything – schools, jobs, the housing market – yet were obscenely lucky along the way. There were no major wars nor huge recessions during our formative years. Our houses went up in price after we bought, as did our retirement accounts. Schools couldn’t be built fast enough, baby food sales surged, and women stayed home to raise their large families.

By the 1960s, the labour force had swollen by 17%. Another 19% in the 1970s (Business Insider). Anyone growing up in that era will tell you how hard it was to get a job.

Music and entertainment often describe a generation:

- If you listened to Elvis, The Beatles, Led Zeppelin, The Rolling Stones, Styx, Supertramp, and Jimmy Buffett, you were a Boomer.

- Same if you watched I Dream of Jeannie, Gilligan’s Island, Bewitched, Gunsmoke, and Perry Mason on TV.

The generation that followed was Generation X. Gen X babies were born between 1965 and 1980 and they were not nearly as lucky. The Boomers held many of the plum jobs with generous pensions and clung to them.

Gen X came of age just as the dotcom bubble burst in 2000, followed by a second even larger bubble in the 2008 Great Financial Crisis. The biggest losses in investment accounts in 2008-9 were those belonging to 1967-1973 birth years, and they had the hardest time finding comparable jobs once they were laid off.

No wonder Gen X’s most notable music style was called Grunge Rock. They also pioneered alternative rock, hip hop, punk, post-punk, rave, and heavy metal.

- If you listened to Drake, Pearl Jam, Nirvana, Tupac, Biggie, Snoop Dogg, Ice Cube, Eminem, and Rick Astley, you are Gen X.

- You watched Doogie Houser, The A-Team, Miami Vice, Beverly Hills, 90210, The Cosby Show, 21 Jump Street, and Friends on TV.

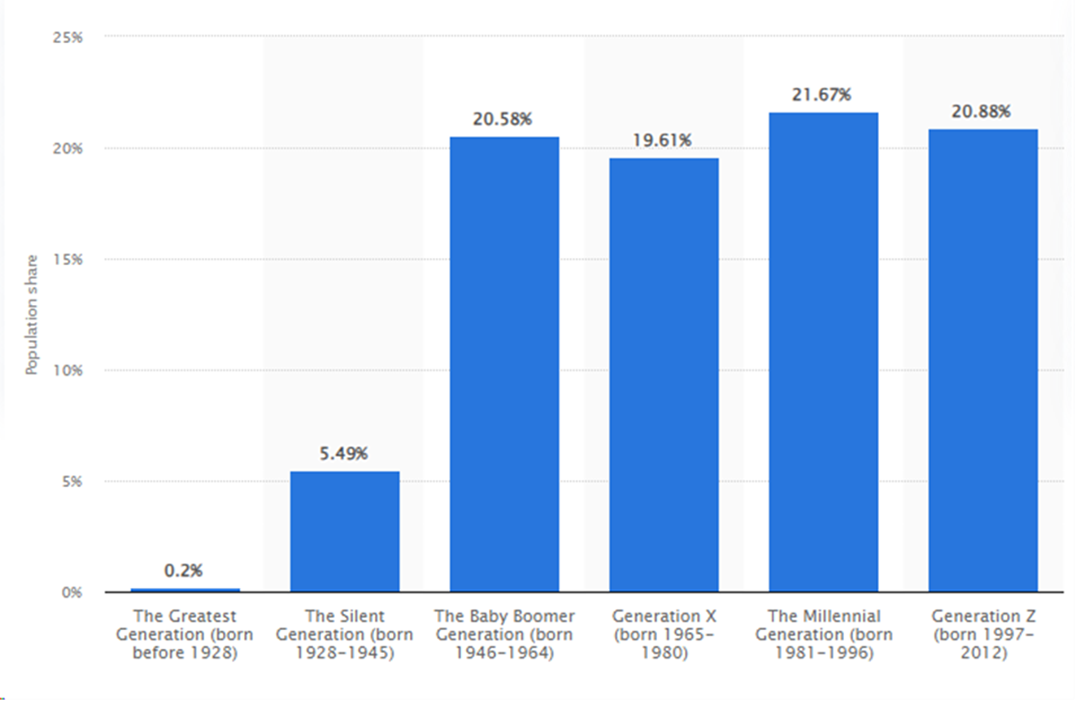

Why the generational discussion this week? It is now official that the Millennial generation has surpassed the Baby Boomers in size. It had to happen eventually. The youngest Baby Boomers are now turning 60 with almost half having retired by now. The Pandemic spurred more to take early retirement, so the labour stage has cleared rapidly since 2020.

Statista

Who are the Millennials? Born between 1981 and 1996, they are the children of the baby Boomers. A smaller generation than the Boomers, they are still larger than the two surrounding them: Gen X and Gen Z. They had helicopter parents who pushed, pulled, praised, and coddled them. They grew up in a low growth world and have had to delay families because of student loans and high childcare costs.

- If you are a Millennial, you grew up listening to the Spice Girls, Barenaked Ladies, Avril Lavigne, The Killers, and Linkin Park, to name a few.

- You watched Family Guy, The Office, Gossip Girl, and The Big Bang Theory until streaming arrived and effectively ended television as we know it.

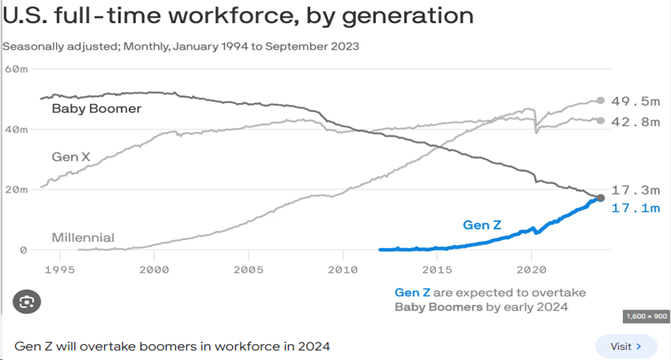

Boomers were the proverbial ‘pig through the python’ bulge, pushing up home prices and shattering music and cultural norms. Now, the largest generation in history is becoming history. Not only do the Millennials now outnumber living Baby Boomers, but the next generation – Generation Z, born between 1997 and 2012 – just passed Boomers in the workforce as of 2024.

Axios

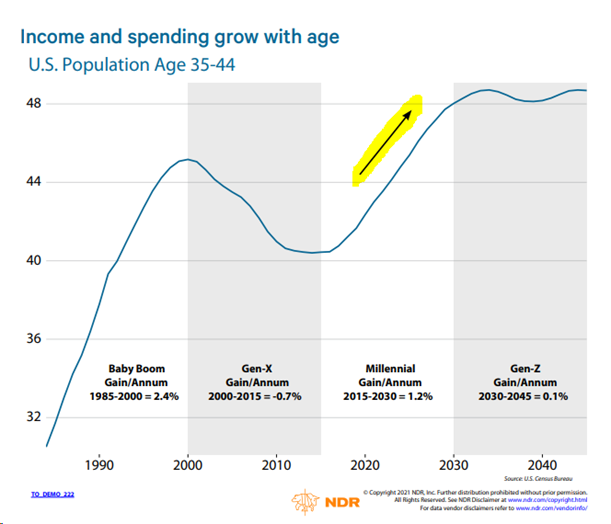

Most importantly, the median Millennial is now between 35 and 44, the ages when both income and spending accelerate. This is also the peak of the family formation years.

What are the implications for investors?

- Employment

Labour markets are likely to be permanently tighter. We can see that now with more job vacancies going unfilled. Professions that used to have a surplus are now crying out for younger workers.

The accounting industry, for example, is seeing record numbers of retirements and not enough new articling students to fill the ranks. Especially because those leaving have decades of experience and are highly productive. It takes years to train a new employee to that level.

“There is an accounting shortage in the US. The American Institute of Certified Public Accountants (AICPA) estimates that about 75% of CPAs would have reached retirement eligibility by 2020. Coupled with a steady decrease in new students majoring in accounting, firms are facing a significant talent shortage.”

- Accountancyage.com

As Boomers retire, younger workers can expect to advance more quickly than before. They can and will demand more benefits. Is it any coincidence that the Work-From-Home wave, where many people are only in the office three days a week, took off just as Baby Boomer retirements accelerated?

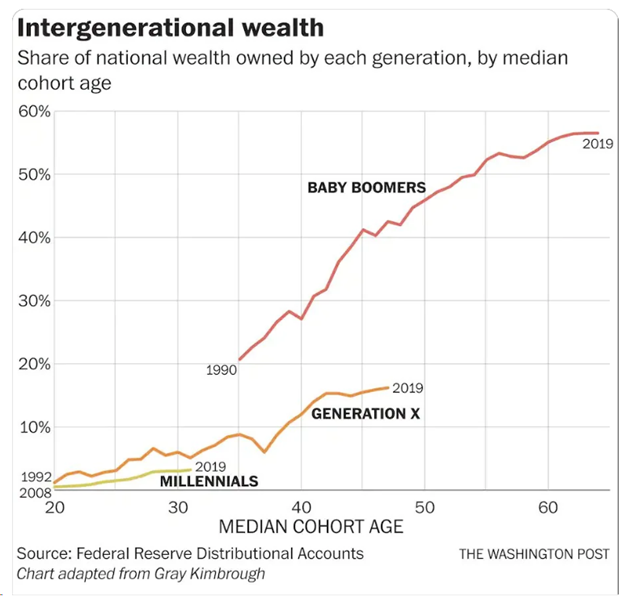

- Wealth Imbalance

The Baby Boom generation hogged all the wealth. We bought cheap houses and made them expensive. We secured generous pensions, medical benefits, and helped ourselves to decades of rising stock markets. We shrunk classrooms (because we had fewer kids) and hired less teachers. We starved the military (fewer wars) and voted in governments who borrowed heavily for our benefit.

Is it any surprise who has all the wealth?

Just by dying off, Baby Boomers will transfer that ~55% share of national wealth to the next generations. That’s $72 trillion headed to heirs. (Cerulli Associates estimate).

But can the population wait that long for all this wealth to be freed up? Will they wait that long?

The top tax rate in British Columbia has risen from 43.7% in 2017 to 54.5% in 2020, a rise of 25%. More than half a top-earner’s pay goes to taxes when they earn above $252,000 at this rate.

Look again at all the wealth in that chart. The government is. Why not raise taxes even higher to get more sooner?

Many parents today are transferring wealth to their children during their lifetimes. Canada has few barriers to intergenerational transfers while the U.S. has an annual Gift Tax limit of $17,000. Make sure you know your rules before you make any gifts to children.

- Productivity

As workers become harder to replace and more expensive, employers will seek ways to increase productivity. AI – Artificial Intelligence – offers the promise of up to 40% more productivity per worker (source: MIT).

Microsoft has the lead here with ChatGPT. Alphabet (Google) just stumbled badly with its Gemini AI tool. Other leaders are Meta (Facebook) and possibly Apple.

- Health Care

Health care needs are surging as the Boomers turn gray. Hospitals are creaking from Canada to the UK - every developed country in the world, to be honest.

There are just too many old people all at once.

One of the biggest tidal waves approaching the medical system is the surge in Alzheimer’s and dementia. In 2020, Canada had about 597,300 people with dementia relying on 350,000 care partners. By 2030, the number suffering from dementia will double (Alzheimer Society of Canada).

There will be creative solutions. More in-home care. Robotics, such as smart walkers to guide and comfort people at the same time. Artificial Intelligence holds tremendous promise to augment aging brains.

And billions are being spent on life extension science.

And, of course, there is Canada’s MAID program where people choose their time to die. We are leaders in this grand experiment and all the world is watching.

The winners here will be just about any health care company, from cancer drugs to obesity pills to joint replacements. The company that discovers an effective treatment for Alzheimer’s could become the Microsoft of the 2030s.

Generational Winners

Finally, we did some thinking about how generations create their own ‘champions’ in terms of investments.

When a person hits age 20, this is approximately when their income and spending begin to rise. This phase can last 20-25 years, so what they choose to focus their spending on can make a company and an industry.

Here are the leading stocks starting at age 20 for the last three generations:

- Median Baby Boomer + 20 years was 1975.

Your best stock to buy and hold: Wal-Mart.

- Median Gen X + 20 years was 1993.

Your best stock to buy and hold: NVR (home construction)

- Median Millennial + 20 years was 2008.

Your best stock to buy and hold: Netflix.

- Gen Z + 20 years is 2024. Now!

Your best stock to buy and hold? Any guesses?

Each of these companies defined the generation, from cheap consumer goods at Wal-Mart, rising home ownership through homebuilders like NVR, to watch-what-you-want with Netflix.

What defines something different about Gen Z?

One area that stands out is the whole idea of transportation without ownership. We used to drive through McDonald’s for fast food. Young people today use DoorDash or Skip the Dishes to have it delivered for a fee. We used cabs. They use Uber.

Every portfolio manager is watching to see how the Millennials spend and how Gen Z will shape the world. For the first time, it will not be the Baby Boomers leading the shift.