Real Estate On Sale

Written by Paul Siluch

July 22th, 2022

Real estate has great allure for Canadian and U.S. investors. Most people have done very well on their homes with prices rising as they have.

Commercial owners of apartments and office buildings have done even better.

Owning real estate has distinct advantages:

- Prices do not vary much year to year

- Rents are a steady source of income

- It appreciates over the years, and offsets inflation in most timeframes

Real estate is coming off a very strong run due to low interest rates. Rates have climbed sharply recently, which has not yet impacted most residential and institutional prices.

Yet.

However, public REITs have fallen sharply.

If you are considering buying real estate today, consider buying it through public market Real Estate Investment Trusts (REITs). These are pools of buildings that sell like stocks on the exchanges.

REITs span every asset class of real estate:

- Malls

- Apartments

- Warehouses

- Office towers

- Data centres

- Refrigeration facilities

- Cell towers

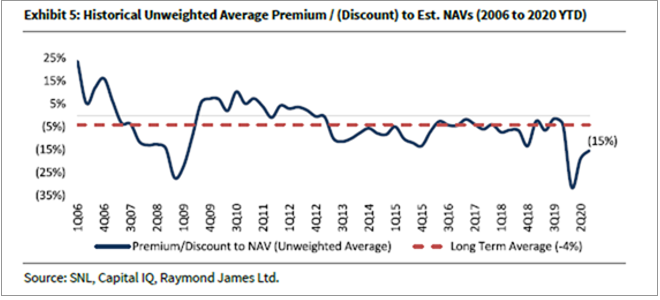

REITs today are trading at the biggest discounts to their Net Asset Values (i.e. what the properties are valued at) since March of 2020. In other words, the “baskets of buildings” are trading for less than the buildings themselves.

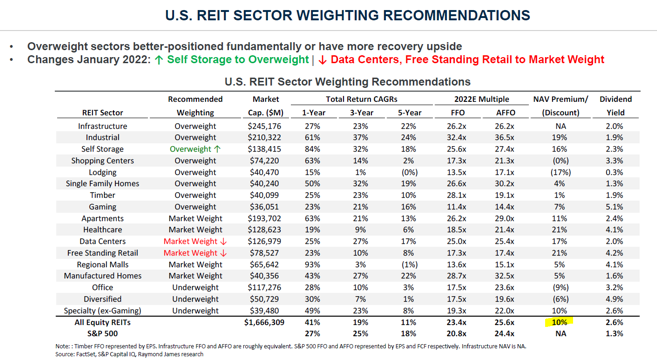

This chart from January shows U.S. REITs trading at a 10% premium to Net Asset Value back in January.

Canadian REITs were similar – they traded at a 10% premium then.

Today, however, Canadian REITs have dropped from premiums to steep discounts due to fears of high interest rates.

Here are ten of Canada’s largest REITs, spanning everything from apartments to office towers to malls to warehouses. They trade at sharp discounts to their NAVs:

76% - Canadian Apartment REIT

75% - Riocan

80% - Granite Industrial

70% - Allied Properties

90% - Choice Properties

83% - Smart REIT

66% - H&R REIT

67% - First Capital REIT

73% - Dream Industrial

84% - Summit REIT

76.4% Average REIT price/NAV compared to 110% in January.

This is a graph dating back from 2006 to 2020. It shows the average discount to NAV of public REITs. It has not been updated since 2020 (we are working on that) but it shows that current price/NAV levels of 75-80% are close to the 2008 and 2020 bottoms:

We own both Canadian Apartment REIT (which owns apartment buildings) and Choice REIT (which owns the land beneath Loblaw’s and Real Canadian Superstores) in our Dividend Value portfolio.

This is a recent comment from our real estate analyst on Canadian Apartment REIT (TSX CAR.UN), the largest public owner of apartment buildings across Canada.

“The recent sell-off in Canadian Apartment REIT’s unit price has created an extremely wide disconnect between public and private market pricing for the Canadian multifamily REIT sector.

Given this pricing dislocation, CAP REIT has established a normal course issuer bid (i.e. they are buying their own shares back).

While there are limits to the activity level that CAPREIT can realistically achieve, we believe incremental unit buyback activity by CAPREIT can provide a positive signal of inherent underlying value to investors.

CAPREIT will consider the sale of non-core assets where it believes premium sales valuations can be attained.”

In other words, Canadian Apartment REIT is selling some of its properties at 100% of Net Asset Value and buying its own shares back at 76% of Net Asset Value.

Real estate investors could consider buying REITs as an alternative to direct real estate purchases. The last two opportunities at these levels – 2008 and 2020 – were ideal buying points.