The Beginning of Better Times

Written by Paul Siluch

July 22th, 2022

“May you live in interesting times” is supposedly an ancient Chinese curse, with “interesting” being the opposite of “tranquil”. The year 2022 certainly has been an interesting time.

Not only has inflation risen to levels not seen in decades, but even bigger changes are afoot.

- India will pass China as the world’s most populous country, if it hasn’t already.

- Nuclear power, once the horror of activists everywhere, has now been deemed an acceptable form of “green” power by the European Union. South Korea, France, and the U.K. once planned to shutter their reactors and are now extending them. Japan is restarting nine that have been idled since the Fukushima disaster.

Stock markets have also been very interesting this year, and not in a good way.

However, we may have seen bad news peak.

On June 14th, for example, the peak in interest rates occurred quietly.

Here’s the yield on the U.S. 10-year bond. It hit its highest point at 3.50 per cent on June 14th and then began to decline.

Source: Trading Economics

Gasoline peaked on June 9th. Crude oil topped out on June 8th.

Source: Trading Economics

Natural gas peaked on June 7th. Milk prices peaked on June 1st.

All of these are components to the Consumer Price Index. Stock prices have been tumbling ever since January as concerns of rising inflation mounted.

The biggest driver of this has been oil prices, of course. Higher oil leads to higher gasoline and diesel prices, which leads to higher food prices and, well, you get the picture. Oil is still what makes the world go round, like it or not. When energy becomes more expensive, everything follows.

So what happened in mid-June? That was the point where sentiment turned extremely sour. Business, consumers, government officials – everyone - decided recession was imminent. Gasoline prices were the big factor. People get depressed when it costs over $100 to fill their car.

People began cancelling trips and “buying down” to save on food bills. It was like a light switch got turned off on spending.

Sometimes bad is good because it marks the bottom. A survey of fund managers by Bank of America revealed the following:

- Record low growth expectations

- Record low profit expectations

- The percentage of their portfolios invested in stocks was the lowest since 2008

- Cash levels were the highest since 2001

Commentator Jonathan Ferro said, "I'm so bearish, I'm bullish!"

Interestingly, the U.S. market bottomed on June 16th. World markets followed one day later.

Source: Trading Economics

So did inflation fall? June’s U.S. inflation number was the highest in decades at 9.1 per cent when it was reported July 13th, up from 8.6 per cent in May. We’ll see what July brings when the numbers come out in mid-August.

What changed was expectations about future inflation. With oil, natural gas, milk, lumber, corn, wheat, and dozens of other commodity prices dropping, expectations are that we have seen the worst.

This means central banks may not have to raise interest rates so much in the months ahead.

Second Half

We have been saying for a few months now that the second half of the year should be better than the first half if historical trends repeat. Records are made to be broken, of course, but history suggests this should be the case again this year.

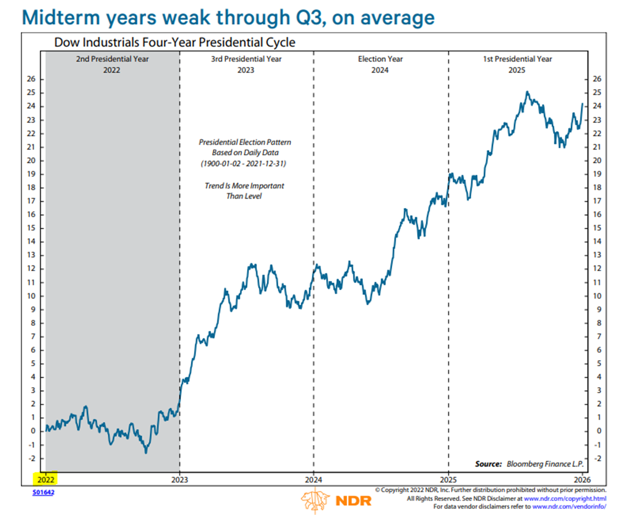

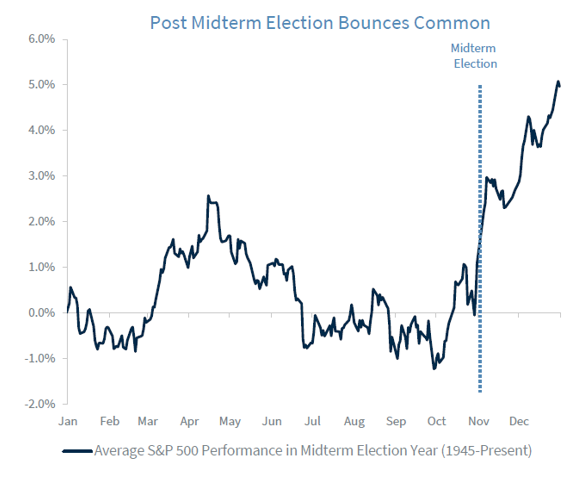

We knew 2022 was destined to be a weak year – U.S. mid-term election years are often poor years for stocks.

The economy is still slowing down and some sort of recession – negative growth for six months – is likely in the cards for 2023. But markets are forward looking and often fall eight to nine months in advance of a downturn.

Global markets peaked last November before the economy began to slow. That was eight months ago. Expectations are low, and this could lead to a rally later in the year.

We still have a war raging in Ukraine, and Europe’s supplies of natural gas are being strangled by Russia. So, the news cycle in the next three months will continue to be grim.

Stock and bond markets may have already hit their lows for the year. History says to be hopeful for the second half.