Fear of the Dark

Written by Paul Siluch

March 16th, 2023

When the light begins to change

I sometimes feel a little strange

I have a constant fear

That something's always near

- Fear of the Dark, Iron Maiden 1992

It is that time of the cycle again, when we become afraid of what we cannot see. Panic over distress somewhere sends stocks tumbling and gyrating.

It happens about every 3-5 years, on average. World events occur that shake markets.

For example, since the 2008 Global Financial Crisis, we have lived through these crises:

- 2011 - Greece’s bankruptcy threatened the euro and entire European Union. U.S. markets fell 21% from 2010 to 2011.

- 2016 – Oil prices plummeted and then Britain scheduled their Brexit vote. U.S. markets fell 15%.

- 2020 – Covid-19 Pandemic. U.S. markets fell 35% in one month.

- 2022-23 – Inflation scare, rising interest rates, bank failures. U.S. markets are down 19% since January 2022 and -8% since January 2023 peak.

Today’s “fear of the dark” was caused by the simultaneous collapses of Silicon Valley Bank (SIVB) and Signature Bank of New York (SBNY). There are many complex explanations as to what happened, but the bottom line is that both were classic ‘bank runs’.

Depositors demanding money – image from Dreamstime

What Banks Do

Banks take your money and then invest it in things to earn higher rates than what they pay you. That’s how banks work. You make 1% and they invest to make 5%, for example.

Banks operate under the assumption that everyone will never want their money all at once, because they would then be forced to sell their investments immediately to get you your money. And these investments might be hard to sell, or the bank may be selling at a bad time. If so, they could lose money.

This is exactly what happened with Silicon Valley Bank. High tech investors were their biggest depositor base, and they were warned in an e-mail blast to get their money out. Billions fled in hours.

Back in 2008, banks had as long as a month to raise new money or find a white knight to buy them if they found themselves in distress. Before 2010, very few people had phones and money transfers were done by hand. Today, we operate at “Twitter speed” where wiring millions is just a click on a phone.

The U.S. government stepped in over the weekend and guaranteed all deposits, regardless of size or ownership (bailing out Prince Harry, among others). Since Monday, relieved investors have been fleeing smaller banks, with Bank of America (NYSE BAC) reporting it took in close to $15 billion in just two days.

So the good news is that small banks just had all their deposits guaranteed. The bad news is that they may have no deposits left.

Meanwhile, the Canadian banks also stumbled, because some of our northern giants have U.S. branches. Bank failures and recessions are never good for any bank, so earnings could suffer. We are not immune, in other words.

However, U.S. regulators tend to look longingly at our stodgy Canadian system. It is oligopolistic and rarely allows new competitors. Our banks are big, broad, and boring with none concentrated in one region. Silicon Valley Bank was primarily a tech-based bank in California and so very sensitive to weakness in that one sector.

Canadian banks generally hold larger capital reserves than in the U.S. system. We have a minimum of 11% where the US minimum is 4.5% (source: Federal Reserve). Most sit closer to 12%.

- In Canada, the five largest banks control 85% of the total commercial banking assets. Canada has 34 domestic banks.

- In the U.S., the five largest banks control just 46% of total commercial assets. (source: St. Louis Federal Reserve). The U.S. has 4,844 federally-insured banks (source: MoneyCrashers).

The trend is towards Canada’s big and boring model. In 1984, the U.S. banking sector had 17,810 commercial and savings banks. This fell to 11,929 by 1995 after the Savings and Loan crisis wiped out thousands. As mentioned above, that number has been cut by more than half to 4,844 thanks to several other bank extinction events.

And yet the U.S. still has 100 times the number of banks we do, with just 10 times the population.

Heavily-regulated, geographically-broad, and over-reserved banks tend to be immune to most bank runs and solvency problems. That is why the U.S. banking sector will eventually become far more concentrated, as Canada’s is.

Meanwhile, one bank’s pain is another bank’s gain. TD Bank (TSX TD) is in the middle of buying a U.S. regional bank, and may be able to negotiate a much lower price, thanks to the recent price drop. Royal Bank (TSX RY), our largest, is said to be looking for its own U.S. regional bank to buy.

Bottom line for the banks we own: don’t panic. They may decline more if markets remain weak, but they are the survivors most likely to benefit once the crisis passes.

“You need patience and discipline and an ability to take losses and adversity without going crazy.”

- Charles T. Munger, partner of Warren Buffett

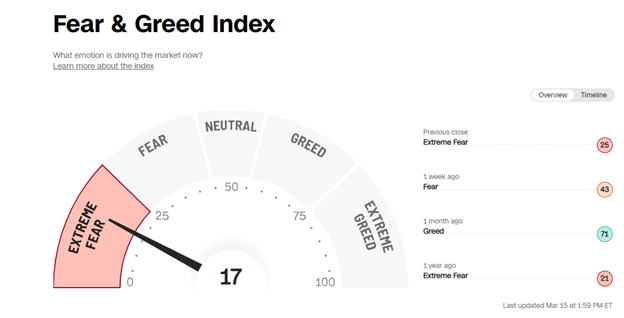

The CNN Fear & Greed Index is extremely fearful today. It can go lower, but purchases made in times like these tend to do well when viewed a year later.

While the markets were weak, not all stocks were. Some sectors barely fell. The drug makers held up well. We are getting older and sicker, perhaps, and need our drugs. The largest of the technology companies were positive. Companies like Microsoft (NASDAQ MSFT) and Amazon (NASDAQ AMZN) won’t be threatened by new start-ups like they have been because these little minnows suddenly can’t get funding with Silicon Valley Bank in receivership.

In summary, we expect rallies and declines over the next few months, so be prepared to hold tight. As Jesse Livermore, the famous stock trader of the 1920s said,

“Buy right, sit tight.”

There will be opportunities to buy great companies on sale during these downdrafts, as well.

As Warren Buffett reminds us,

“The best chance to deploy capital is when things are going down.”