Currency Wars

April 12, 2023

We have had calls from a few clients worried about the decline of the U.S. dollar as the world’s reserve currency. Yes, it is true that the dollar’s share of global reserves has shrunk from 68 per cent of global currency reserves in 2002 to about 58 per cent today:

Should we be worried? The dollar’s share of global currency reserves is actually just back to where it was in 1995.

The short answer is no, we shouldn’t be worried. Or at least, not yet. To paraphrase the dollar's fate in the immortal words of Monty Python, “it's not dead yet."

Source: Monty Python’s “The Holy Grail”

The big worry is that the U.S. dollar is going to decline because of internal discord, deficits, and debasement. What could replace it? Many say the Chinese renminbi (also called the yuan) because, as the world’s second largest economy, China should make up a far bigger slice of global currency wallets.

And yet, China is stuck at 2.69 per cent of global reserves – even the tiny Canadian dollar makes up over 2.38 per cent of global reserves (source: IMF).

The U.S. dollar is still king. The biggest thing that crowns it? The openness of the United States itself. If you have U.S. dollars, you can buy U.S. real estate, factories, companies, and shares anywhere in the country. Commodities, other currencies, property…stuff.

In China, you can’t. Foreign ownership is very restricted, if not outright prohibited in many sectors. The yuan itself is pegged to the U.S. dollar, so it doesn’t even trade independently.

Why just 2.69 per cent? If you hold billions in yuan, what can you buy with it?

A huge manufacturer of submarines and missiles? Northrop Grumman (NYSE NOC) trades in the U.S. - yours for the taking, all day long. In China, the analogous company would be China Shipbuilding Industry. Don’t even ask if you can own it – you can’t. It is state-owned.

Commercial real estate in China is also restricted because all real estate is technically owned by the Chinese state. What you “buy” is a 70-year lease, even if you are a local. Same for factories and most other businesses. Yes, a foreigner can buy one residential property under certain conditions, but China has strict capital controls. You can move money into the country much easier than you can get it out.

U.S. dollars can be bought, sold, and invested in seconds because it is the most liquid market in the world. And despite all of America’s problems, it is still a very open economy.

As Larry McDonald of The Bear Traps Report says:

“Let’s be reasonable: would you rather try to foreclose on a factory plant in the USA or in China? Would you rather fight a speeding ticket in the USA or Russia? Do you really believe U.S. economic activity will decline to a fraction of China’s in the next twenty years? No. You don’t.”

That being said, China is increasingly promoting the yuan in transactions, such as oil. France and Saudi Arabia have both done yuan energy sales recently. A transaction is not a reserve holding though, just as a Visa card is not a bank. The yuan can be used as the currency transacting a sale, but only if China ensures there is sufficient yuan available for the buyer and seller to get in and out of the trade.

Yes, we are definitely going to see more yuan transactions in the years ahead because China wants to see more trade done in yuan. But investors will still have problems holding yuan even as they trade with it.

What about Gold?

Gold’s is now about 15 per cent of global currency reserves versus 10 per cent a few years ago. Central banks have been buying lots of gold lately, suggesting a shift in preference from the dollar to the shiny yellow metal. Part of this is due to the U.S. government turning the dollar from a currency into a weapon. Recall that Russia’s overseas dollar holdings were frozen when it invaded Ukraine and sanctions were imposed on countries aiding Russia. This put a chill in many despots’ hearts and sent them selling dollars to buy the next best reserve asset: gold.

Gold will remain a part of most central bank assets, simply because it is a “currency” that has held its value for over 5,000 years. It could rise further if a commodity-linked currency is created in the years ahead.

Will gold replace the U.S. dollar? Gold made up 70 per cent of global reserves as recently as 1980. There is simply not enough physical gold to ever return to those levels again.

Gold will always be a part of the global reserve mix, and it has room to rise from here. Because it is heavy and hard to transact in, however, it will always have problems replacing modern currencies.

Sources: International Monetary Fund (IMF); World Gold Council; BIS calculations.

Conclusion

The U.S. dollar may weaken against other currencies, as it does during many cycles. In times of inflation, countries such as Canada, Brazil, and Australia typically see their currencies strengthen against the dollar because of our natural resources. This hasn't been the case yet, however.

It isn’t bad for a country if the currency declines. The United Kingdom lost its status as the world’s reserve currency in 1944 and yet, remains as a key foreign currency (five per cent of global reserves). Exports increase when a currency shrinks, and the U.S. has long complained about its manufacturers becoming uncompetitive.

The biggest change we may see in the years ahead is a shift to a basket of major currencies, gold, and possibly some other commodities as the new “global reserve unit.” This could cause the importance of the U.S. dollar to slide further, even while it would still be a major component.

Until then, the U.S. dollar is the biggest and most liquid currency because of its unified central bank (Europe lacks this), relatively free market (China lacks this), and growing population (Japan, China, and Europe are growing much more slowly or even shrinking).

“This is not because the U.S. currency is perfect, but simply because, at least for now, the U.S. dollar is still the top dog in a weak pack.”

- Eugenio Aleman, Raymond James Chief Economist

Markets This Week

Inflation came in lower than expected this week, up just 0.1 per cent in March (source: FactSet):

January +0.5%

February +0.4%

March +0.1%

This is good news in terms of interest rates. Canada has already paused its rate increases, and the U.S. probably has just one more to go.

Stocks have rallied with the end of the hiking in sight. Earnings season is about to start, however, and we remain cautious. Too many companies are facing shrinking profits due to high rates and careful consumers, and remember the banking crisis a month ago? We are about to see fewer loans, as a result.

Global Perspectives

I had lunch with a five-star global equity manager this week. They pay close attention to valuations and are quite different from others we follow.

For example, they hold just 27 per cent in U.S. stocks whereas global indexes hold close to 60 per cent.

A few interesting themes came out during the talk:

- They see Japan and the United Kingdom as undervalued markets and hold large stakes in both.

- India – now the world’s most populous country – is severely under-banked. This will be a growth area as the middle class expands.

- Technology and improved use of data are making traditional mining (how and where to drill) and fertilizer companies (how and where to plant) far more profitable.

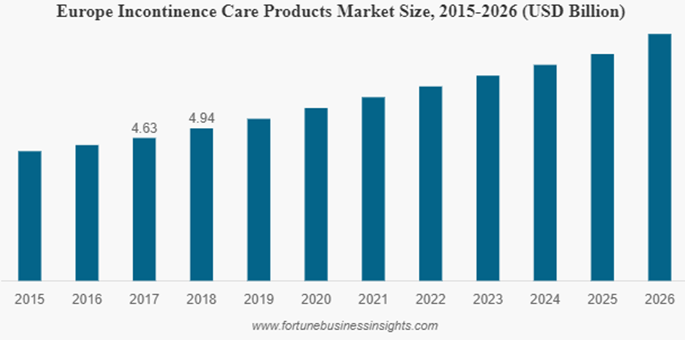

- A recurring theme? A growth market all over the world – and a component of three of their companies – is adult incontinence. Thanks to the world’s aging population, this market is expected to grow at a five per cent clip over the next decade. Ponder that for a minute…

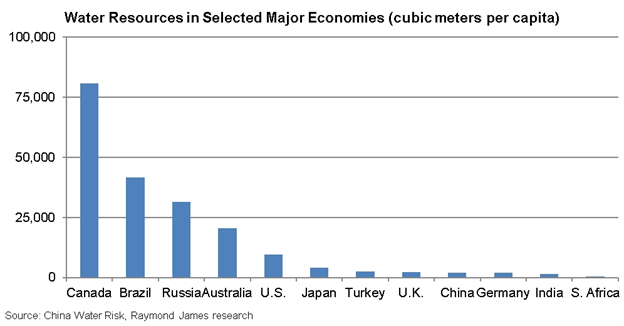

A final interesting statistic crossed our desks last month.

Brazil, Russia, the U.S., and Canada hold the world’s largest fresh water supplies, in that order.

However, because Canada has so few people compared to these countries, our available water resources per person are the highest in the world by more than double.

Water is not a globally-traded resource, like oil or minerals. But with many countries experiencing water shortages, could this change? And does that help Canada, or make us a target?