The Fourth Turning

Written by Paul Siluch

April 26th, 2023

Image by vecstock

In the 2nd century BC, the Greek philosopher Polybius studied the history of city-states and noticed something: they all seemed to follow a similar pattern of growth and decay over time, like the four seasons of the calendar.

Each progressed from kingship to aristocracy, then to democracy, and finally to anarchy.

Fifteen hundred years later, the Islamic scholar Ibn Khaldun observed the same cycle in medieval Islamic dynasties:

- The first rulers governed with unquestioned authority, either by a strong leader or a willing populace.

- The second rulers – the aristocracy – admired the king but assumed control as the king’s children were weak. Too much power concentrated in too few hands.

- This led to a democratic rebellion, but the dynasty was weakened further by this third generation.

- The fourth and final stage was one of polarization and the crumbling of structure.

Which then led to a new king seizing control and the cycle repeating.

Most historians focus on individual people, events, empires and the enduring impacts of this linear progression of self-improvement, whether it is from increased knowledge or education.

What set Polybius and Khaldun apart was how they saw history progressing through repeating cycles of approximately 100 years. The Russian economist Nikolai Kondratiev studied business cycles and observed similar patterns in the world of commerce (although his cycles only lasted about 60 years). Long-term watchers of commodity cycles today refer to these as Kondratiev Waves.

“There is nothing new under the sun.”

- Ecclesiastes 1:9

In 1997, the book The Fourth Turning by William Strauss and Neil Howe popularized this theory of social “seasons”, focusing on the Anglo-American era. It separated each period as follows with the most recent eras shown:

First Turning – High (1946-1964)

Second Turning – Awakening (1964-1984)

Third Turning – Unraveling (1984-2005?)

Fourth Turning – Crisis

Strauss and Howe work suggested there have been seven turnings since the 1400s as Britain, and then the United States, grew in world influence. The Anglo-American world survived each crisis to emerge stronger than in the previous cycle.

Since the book was written during the so-called Third Turning (1997), the authors made some bold predictions about the years to follow. Namely, they postulated that America could experience a fiscal crisis, a terrorist attack, a pandemic, and some sort of Russian civil war.

The fact that their predictions mostly came true meant the book became even more popular long after its publication.

Now, the wider the net, the bigger the holes. The Fourth Turning is a very comprehensive social theory that makes broad assumptions. Many historians deride it as pseudo-science, Nostradamus astrology, and pop fiction rolled up into a bestseller. Any book predicting the future can be accused of the same, at least in part.

But even the critics acknowledged that the authors made some interesting points. Especially about history repeating itself every 80-100 years as one generation forgets everything the previous generation learned.

“What the elders see while sitting, the young ones standing on their toes won't see.”

- African Proverb

Why mention a 1997 book today?

Well, two reasons.

First, the sequel The Fourth Turning Is Here is due out on July 18th. Those of us who enjoy history, economics, and (just a little) pseudoscience are eagerly anticipating it.

And second, there are cultural aspects to look forward to. Music for example. Mozart and Beethoven were both born during Fourth Turnings, as were Stravinsky, Elvis Presley, and the four Beatles. Beethoven’s greatest symphonies were described as progressing from storm and stress to triumph, which describes the Fourth Turning era in which each of these composers grew up.

These years are often times of musical experimentation, as we saw in epochs past. Mozart and Beethoven each used larger symphonies and Beethoven pioneered minor keys for tension and drama. Elvis and the Beatles helped pioneer something called rock’n roll.

Yes, it is a stretch to overlay musical culture on top of a demographic cycle, but if it means a new wave of dramatic musical innovation ahead, well, at least we have that to look forward to.

Summer of 2023…

…is shaping up to be an interesting one for other reasons.

The economy is slowing down, for example. This should surprise no one, for it is the wish of central banks all over the western world. Asia is the outlier, because China only recently emerged from its Covid-19 lockdowns and is stimulating its economy even as we try to slow ours.

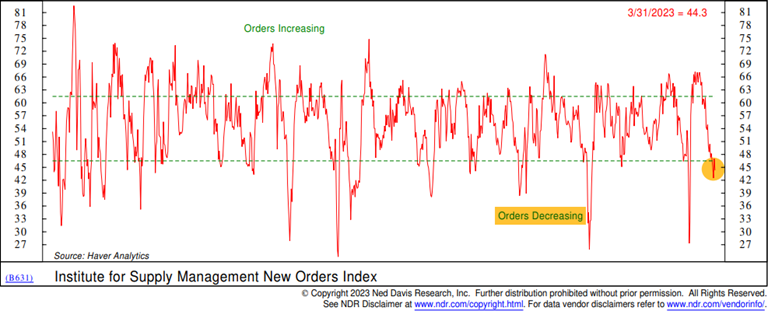

For example, manufacturing is slowing as people pull back on buying stuff.

Ask any retailer – sales are slow this spring as the price of food, taxes, and other essentials crowd out non-essential spending.

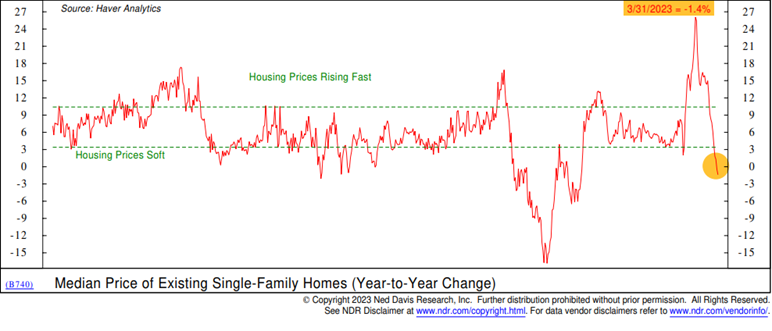

Real estate has also suffered. The economy grows fastest when home prices are rising because money made from real estate flows back into furniture, renovations, and other goods.

High interest rates have sent home prices lower, which is another dampening factor. Commercial real estate in the largest cities is also in trouble due to work-from-home vacancies.

A nation-wide government strike doesn’t help either.

But as The Fourth Turning reminds us, everything goes in cycles.

“To every thing there is a season, and a time to every purpose under the heaven.”

- Ecclesiastes 3:1-8

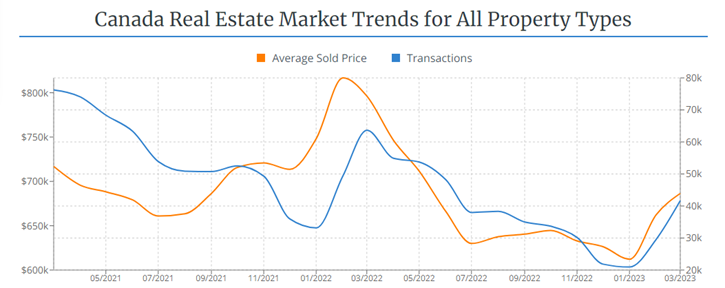

Canada has been a leader in interest rate policy over the last two years. We hiked rates faster, but we also paused earlier. The Bank of Canada hiked for the last time on January 26th of this year, at which time it announced it was pausing to observe the effects.

Notice how property prices bottomed almost to the day across the country.

source: Wowa.ca

The weakest companies in the hardest hit sectors are beginning to experience bankruptcies. Bed Bath and Beyond, David’s Bridal, the largest wedding gown store in North America, are the two most recent casualties. We are also likely to see several more regional banks fail and be absorbed into larger banks in the U.S.

However, other companies will prosper, and are prospering. McDonald’s and other fast food chains are relatively resilient compared to more expensive restaurants. I say ‘relatively’ because they have their own cost issues, from food inflation to a shortage of workers. Still, they are net gainers in this field.

Wal-Mart and Costco are faring better than most others in the retail space. Utilities, pipelines, and phone companies tend to hold up better, as these are essential services. Other near-essentials, such as auto repair companies, mattress stores, and alcohol distillers can outperform during recessions.

And times of economic and geopolitical stress – the war in Ukraine certainly qualifies under the latter category – can lead to rapid technological change.

For example, the 1930s – the last Fourth Turning, by the way - were a dark time worldwide. However, jet engines, televisions, photocopiers, synthetic rubber, and nylon were all developed and introduced in the 1930s. Companies like Hewlett-Packard, RCA, Raytheon, and IBM all grew exponentially in this decade.

Microsoft is an interesting company to watch today. Historically expensive, it is bucking the slowing trend of its peers by continuing to grow. What is its secret sauce and can it continue? It is hard to grow when you are already the third largest company in the world, as measured by market capitalization. But Microsoft’s rapid adoption of artificial intelligence through its ChatGPT interface is a game changer.

I used ChatGPT to research the musical styles above as they relate to the Fourth Turning. The results were light years ahead of conventional search algorithms.

AI may replace me in the long-term, but in the short-term, it has made me more productive.

First Time Home Buyers (in Canada)

Source: pvproductions

The Canadian government really wants to help young people buy houses. It really wants to help. The new First Home Savings Account recently introduced is pretty amazing in all it offers:

- You can contribute up to $40,000 towards a down payment. There is a limit of $8,000 per year.

- You can skip years – your $8,000 annual contribution room carries forward.

- Here’s the good part: contributions are fully tax-deductible while withdrawals for a down payment are tax-free. So, save tax on the way in and never pay it on the way out. That is better than any RRSP, TFSA, or US IRA plan.

- An account can only be held for a maximum of 15 years or until the account holder turns 71. If unused, you can transfer it to your retirement plan (RRSP or RRIF).

These are expected to be rolled out this July. From a tax point of view, it is an amazingly generous plan.

Contact us if you would like further details.