The Emperor Strikes Back

Written by Paul Siluch

August 1st, 2023

“Money makes the world go round” is a lesson learned many times throughout history, and one we are about to learn all over again.

When Rome fell to the barbarians in the year 476 A.D., it actually only half fell. Rome had split and moved a second capital to Constantinople – modern-day Istanbul - decades before because that was where most of the empire had moved.

The Eastern Roman empire was not without its own problems. It was a crowded neighbourhood, with Persians to the East, Slavs to the west, and barbarian hordes to the north. All of them tried hard to topple the New Rome over the centuries. A Prophet named Mohammed and the emergence of his huge new Arab nation, plus the bubonic plague, nearly accomplished this. Byzantium - as the eastern Roman Empire came to be known - almost vanished by the late 700s. What remained struggled. It could barely pay its soldiers and corruption was rampant.

Along came an emperor named Nicephorus in 802 A.D. He was about 50 when he donned the purple robes, which made him ancient, as far as emperors went in those days.

…not unlike the recent string of U.S. presidents, but I digress…

Nicephorus was an experienced bureaucrat who witnessed firsthand how many of the richest citizens dodged their taxes. He didn’t even know how many people he ruled over. He acted quickly to fix this.

The new emperor began his reign by commissioning a census on every inch of Byzantine territory. How many people lived there. What livestock they owned. Which buildings and farms belonged to whom.

Nicephorus increased the tax levels for everyone, placing extra attention on the rich evaders. Tax collectors worked on commission in those days, which meant they could be ruthless. He doubled their number.

Nicephorus was not terribly popular to begin with. He became hated once the tax hikes started. Byzantium’s richest citizens were hauled before him, flogged, and stripped of their lands for back taxes.

Time passed and tempers receded, but the taxes continued. Nicephorus eventually lost a battle with the Bulgars to the north and proceeded to get his head chopped off when his soldiers deserted, making him the first Roman emperor in centuries to be killed in battle.

Few remember poor old Nicephorus except for those historians who study taxes. His reforms – listing every taxpayer, increasing tax brackets, and especially the closing of “loopholes” for the richest citizens – helped the Byzantine empire build a reserve of gold that helped it last another 600 years. The Byzantine coin – the gold solidus – was the strongest and most used currency throughout Asia and Europe for centuries.

Our Modern Finances

Canada spends more than it brings in. Our last balanced budget was in 2015 and we will spend $40 billion more this year and $42 billion next year (Montreal Economic Institute). These are supposed to be the “recovery” years after the Pandemic when we pay back our debts.

And the U.S.? Even worse. The U.S. deficit is typically ten times what ours is (that’s a loose rule-of-thumb based on population) but is projected to reach $1.6 trillion next year – four times what Canada is overspending (Congressional Budget Office).

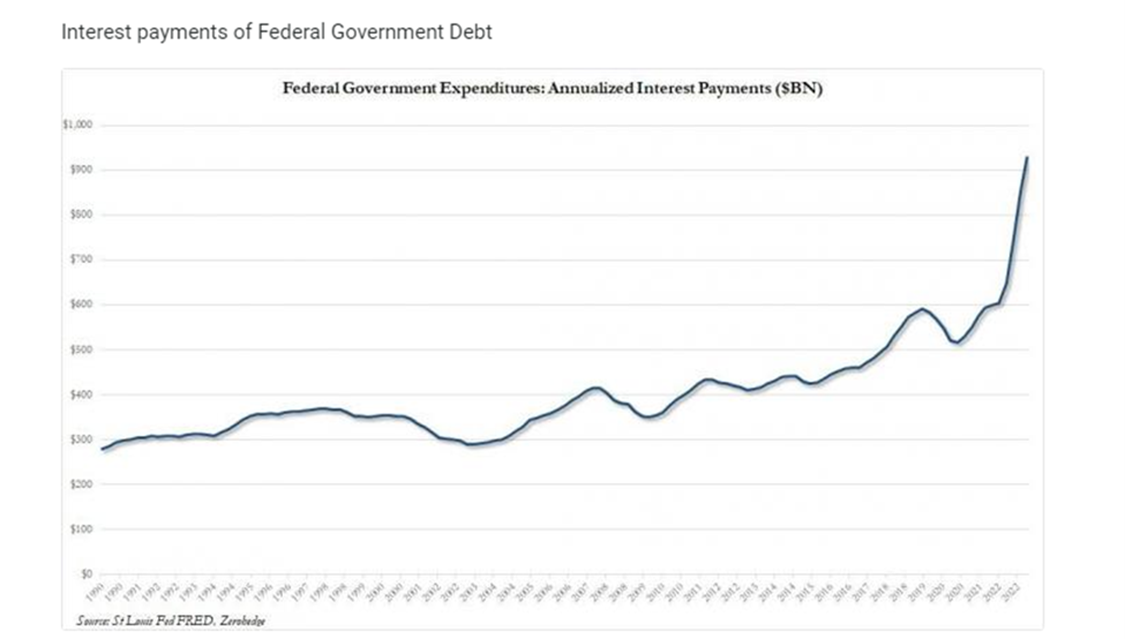

Interest on the national debt has almost doubled since 2020 in both countries. This graph shows U.S. interest on its national debt. Canada’s rise is exactly the same.

"If something cannot go on forever, it will stop.”

- Stein’s Law

Money doesn’t grow on trees, and nor can we print it forever. We tried that in 2020 and it helped briefly. But then we got crippling inflation. We need to stop spending more than we earn yet have no plans for this.

Or we can raise tax rates to balance things out. We definitely have plans in place for that.

Channeling Nicephorus

Nicephorus may have already shown up in spirit. Canada recently gave new teeth to its Alternative Minimum Tax for 2024, where the richest will no longer be able to hide income through deductions and loopholes. We raised carbon taxes this year and plan to hike even more.

Don’t forget the flogging and stripping - the reign of Nicephorus was a painful time. The richest in Canada and the U.S. must prepare for higher tax rates in the years ahead.

Nicephorus also got his head chopped off. It was a small price to pay for the greater good, but it stands as a warning for modern political leaders: you won’t be popular doing what needs to be done.

It did pave the way to a better future. By solidifying the income of the state, it helped the Byzantine empire become the oldest of its era and lasted another 600 years.

The Economist David Rosenberg

I have followed David Rosenberg – Rosie, as he is known – for decades. He was the economist for Merrill Lynch Canada in the 1980s and 1990s, then moved to Gluskin Sheff. He is seen as a ‘perma-bear’ because he is a glass-half-empty kind of guy.

Today, he sees a recession in our future. He’s been early (and wrong) so far. No surprise that he leans pessimistic.

One area Rosie is optimistic about is Canada. World growth has been stronger than expected, and that has helped commodity prices. The war in Ukraine drags on, pushing grain prices higher. Nuclear power is now ‘clean and green,’ helping uranium prices. Canada has some of the richest reserves in the world.

Rosie’s advice is to look beyond the technology boom and A.I. craze and invest to the north once again. Valuations are much lower for Toronto-based stocks than for New York shares, and with emerging markets like India where China was in 2005, Canada is poised to supply them with the resources they need to industrialize.

Commodities fell as interest rates climbed for the last 18 months. The recent reversal helps Canada and Canadian equities: