Where Are They?

Written By Paul Siluch

July 20th, 2023

When the ancients stared into the sky at night, they saw themselves in the stars. People, animals, gods, demons – the night sky was the palette of their imaginations.

In the decades after the first flight of the Wright brothers in 1903, people looking up now saw not only birds, but airplanes. Our world now included humans in the sky, as well as on the Earth.

Our imaginations really opened up with the advent of jet engines, rocketry, and the atomic bomb after 1945. Suddenly, we could not only imagine going to space using brand new science, but we also saw it in real life. It was in 1947 that the first official UFO sighting was made public by a pilot in Washington State.

"Businessman Kenneth Arnold claimed to see a group of nine high-speed objects near Mount Rainier in Washington while flying his small plane. Arnold estimated the speed of the crescent-shaped objects as several thousand miles per hour and said they moved “like saucers skipping on water.” In the newspaper report that followed, it was mistakenly stated that the objects were saucer-shaped, hence the term flying saucer.”

- History.com (image from Freepik)

Sightings began to pour in. In 1948, the U.S. Air Force began its first official investigation into UFOs, called Project Sign. This was followed by Project Grudge and Blue Book right through the 1960s. The public’s interest was further inflamed by reports of a downed alien craft in Roswell New Mexico that authorities claimed was simply a weather balloon. Conspiracy theories about Area 51 and the “Roswell Incident” still abound today.

Were they real? Do aliens exist, and are they here now, spying on us? We must be pretty darn interesting for an alien race to travel thousands of years (which aliens would have to do to even get to Earth) just to harass a few airplanes or abduct the odd farmer.

We imagine what we fear, and then we fear what we imagine. Either aliens only started being interested in us once we developed space travel, or we only started imagining aliens once humanity progressed to this level. Either way, it is an odd coincidence that UFO sightings happened exactly after the post-1945 discoveries of rockets and nuclear fission.

Most sightings can be explained by optical illusions or atmospheric anomalies. The moon “follows” you when you drive because of its great distance. Rain, fog, meteor trails, and thermal discontinuities can explain many of the rest.

But there are a few sightings that cannot be explained. A former U.S. Navy pilot turned whistleblower has prompted the U.S. House of Representatives to investigate whether the military has hidden research on alien contact. The Unidentified Anomalous Phenomena (UAP) Disclosure Act was introduced last Friday and is receiving key support from both political properties.

Who knew it would take aliens to bring Republicans and Democrats together?

If the X-Files tagline is true - “the truth is out there” – then it behooves us to make contact. And if not, then we need to come to grips with the actual truth: only we can solve our Earthly problems.

Is this the real life? Is this just fantasy?

- Queen, Bohemian Rhapsody

The markets today offer a clumsy parallel to my UFO story above.

There is evidence of vast amounts of money pouring into stocks. We can’t see where it is from or who is responsible, but we know it exists. Just like UFOs.

Let’s look a little closer at this Unidentified Anomalous Money Phenomena.

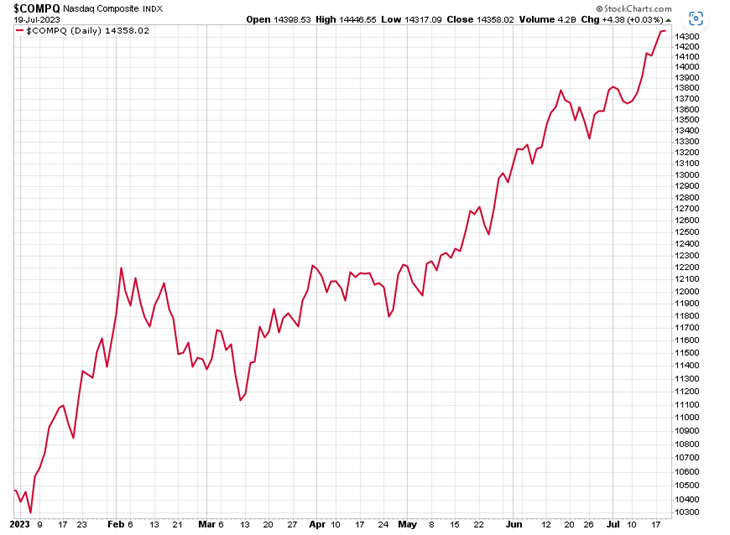

A few stock markets have done very, very well this year. The NASDAQ index has risen the most to June 30th in its 52-year history (Forbes).

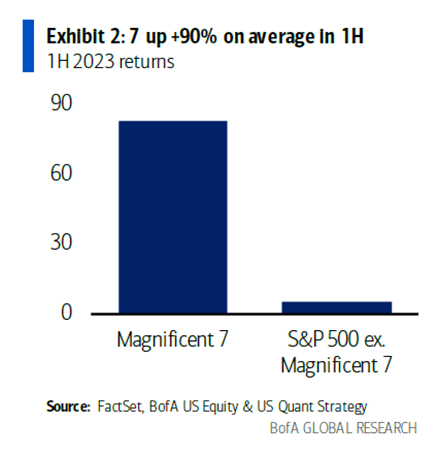

Most of the gains are attributable to just seven stocks. The mega-sized technology stocks - Nvidia, Amazon, Alphabet, Meta, Microsoft, Tesla, and Apple – are responsible for almost all of the gains.

To look at these seven stocks, you would think the economy is on fire and conditions are great. Are they though?

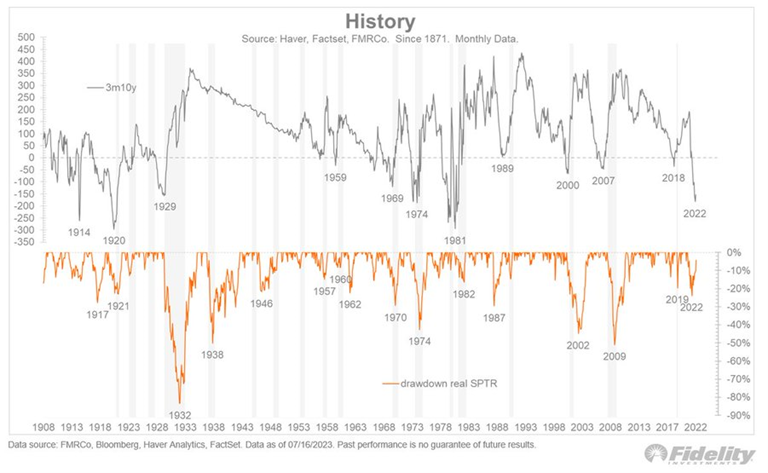

Interest rates are deeply inverted. This means 1-year mortgages cost more than 5-year mortgages.

The 15 inverted yield curves in the last century have preceded a recession every time but one (1966).

We have not had this deep an inversion since 1981. Most economists today predict a recession – they just can’t say when.

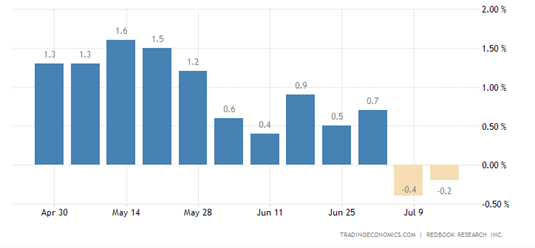

This is a chart of retail sales in the U.S.

They don’t look that great.

Even Tesla has put its cars on sale to reduce inventories.

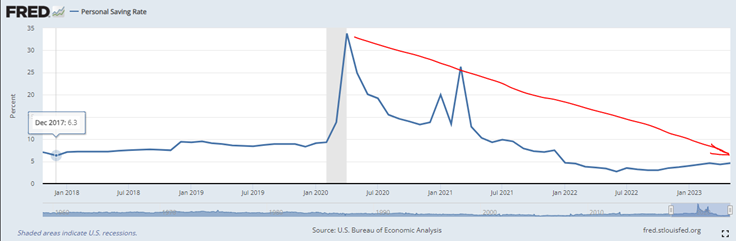

Are there excess savings left over from Covid cheques?

The U.S. personal savings rate ballooned when we stayed home during the pandemic. It is at 5% now, below where it was in 2018.

We’ve spent most of this money.

Perhaps it is government money printing?

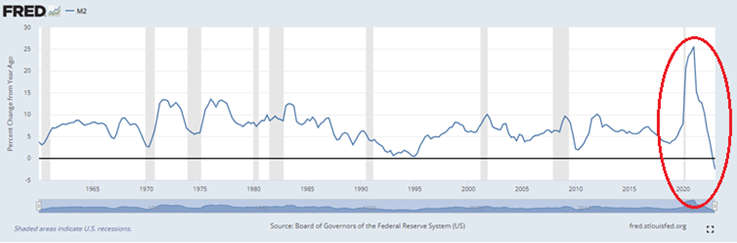

Nope. Just the opposite – the M2 gauge of the U.S. money supply is being drawn down quickly by our central banks. We feel it through higher interest rates:

Maybe investors are excited and throwing all their money at these seven stocks? There may be some of that happening, but sentiment today is mixed. While most people are happy to see stocks rise, they are angry about their wages.

Inflation has eroded any wage gains earned so far, resulting in record strikes:

- American Airlines pilots rejected a generous offer because it was below that won by United Airlines pilots.

- Canadian longshoremen went back on strike, rejecting a mediated offer. This affects billions in Canadian exports.

- 340,000 workers at UPS could go on strike on August 1st. This would be one of the largest strikes in history.

As we have pointed out before, it is not all stocks going up. It is 7 stocks in the S&P 500 going straight up while the other 493 have done very little.

Perhaps the truth is that there is little new money coming into the market, with most of the existing money going to the “Magnificent 7”:

What we know from history is that in similar times of high concentration – the Nifty Fifty rally that ended in 1973 and the dot.com frenzy that ended in April 2000 – what followed was underperformance by the winners and outperformance by the rest. It just took time.

And, we don’t know how high the Magnificent 7 can go just yet. Most pension funds and institutions are already overweight all seven, so they can’t be expected to buy much more. But, rallies can rip higher than you expect.

So, while we aren’t sure where all the money is coming from, we do know opportunities lie in the ignored part of the market. This is medium and small-sized companies, as well as a few sectors like the telco sector.

Canadian telcos, data centres, and U.S. antenna tower stocks all benefit from increased data and artificial intelligence spending, yet they have all slumped. We are looking closely at all of them.

In the meantime, maybe it is all a government coverup. Maybe the aliens are here, and they are the ones buying up all our stocks…

Ryan O’Bryan image