Sin, Debt and the Modern Indulgence

Written by Paul Siluch

July 18th, 2025

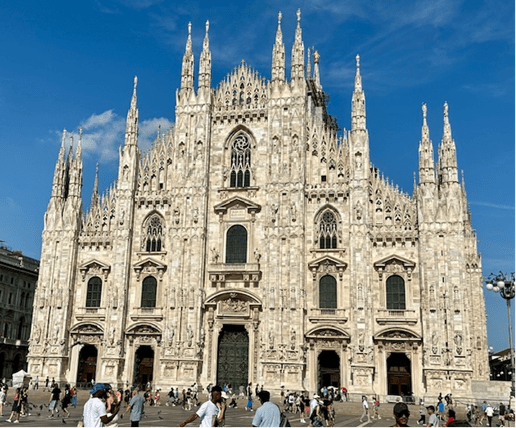

June 2025 personal photo

A recent trip to northern Italy got me thinking about sin.

Not sinning – sin. And its current financial parallel.

The grand Milan Cathedral – the Duomo di Milano – is the third largest cathedral in Europe. It took almost 579 years to complete at a cost of approximately US $600 million in today’s dollars (AI estimate). Expensive today, it would have been cosmically expensive for medieval European worshippers,

To finance such grand edifices, the Catholic church became very creative in its fundraising.

The Catholic faith is unique in its handling of sin. Given we are all sinners (to some degree), the church encouraged its followers to confess to their sins weekly to gain forgiveness.

Confession is a powerful tool. It keeps your congregants coming back. No confession; no absolution. No absolution; no Heaven.

There are different degrees of absolution, however. Small sins can be forgiven by the local priest. Bigger ones? These can take years of atonement.

Wouldn’t it be nice if there were a way to wipe the slate clean all at once? The little sins and the big ones?

It turns out there is. It is called an indulgence. This is an act or a good deed that earns a complete Hail Mary to absolve everything at once.

They were rare in medieval times, but they were occasionally granted.

The Holy See Sets a Jubilee

In the year 1299, the reigning pope, Boniface VIII, noticed an unusual amount of worry among his faithful. The turn of the century loomed like a black cloud, not unlike our fear of Y2K in 2000.

Funny how humans fear big round numbers. We haven’t changed a bit.

Pope Boniface declared the year 1300 to be a Jubilee year. In the Judaic faith, a Jubilee year is a time when debts are forgiven and slaves set free. The Jewish Jubilee happened every 50 years and was a restarting of the societal clock. A chance for everyone to begin anew.The Catholic Jubilee of 1300 was a spiritual restart. Anyone who made the pilgrimage to Rome would be granted an indulgence - a complete cleansing of their spirit - from all past sins. Even the big ones that needed years or atonement and clean living.

All wiped clean. A little donation wouldn’t go unnoticed, either. This marked a shift from an act to a payment for an indulgence.

It was an enormous success. Thousands made the pilgrimage to Rome to pass through the gates of St. Peter’s cathedral. These lucky travellers received a free pass into Heaven, and who wouldn’t want that?

The Catholic Jubilee was set to occur every century. A century is a very long time to wait, however. Because of its popularity, and because church coffers overflowed from the donations of the now sin-free pilgrims, the new Pope Clement shortened the span to 50 years with the next Jubilee in 1350. It was even more popular than in 1300, and more profitable.

In 1450, another pope reduced the wait to 25 years. If an idea is good, run with it, right?

More cathedrals were built across Europe, including the largest of them all, the rebuilding of St. Peter’s Basilica in the Vatican. It began in 1506, at an estimated cost of over $1 billion today.

After the 1475 Jubilee, Popes gave themselves the right to open the doors of St. Peter’s on any day they liked, essentially allowing absolute forgiveness of sin at the whim of the church. By the 1500’s, senior clergy were selling indulgences for money to keep up with church building costs.

The business of sin has always been profitable. The Catholic church turned the forgiveness of sin into an even more profitable venture. If you could buy a ticket to Heaven, why even avoid sin at all?

Of course, this led Martin Luther to accuse the Catholic Church of degrading the value of a virtuous life. From his rebellion came the 95 Theses challenging indulgences and Church authority, and the Protestant faith was born. Its focus was on how well you lived rather than how well you confessed.

The Modern Indulgence: Debt

Central bankers once moved interest rates in the same tight-fisted manner that pre-1300 popes granted indulgences. Cuts to interest rates were rare because they caused inflation and devalued currencies, the most cardinal sins of money.

So, finance chiefs moved rates carefully.

In 1987, the October stock market crash caused a panic about a new Depression. Stocks fell 22% in a single day. The U.S. Federal Reserve slashed interest rates to encourage consumers to borrow and spend to prevent it.

It was small compared to today. But it worked and the stock market was saved.

- When the next major crisis hit in 2000, they dug out the playbook and did it again. This time much bigger to bail out the collapse of the dotcom economy.

- In 2008, they cut rates below zero to bail out homeowners, and the banks who lent to them. Even bigger.

- In 2020, they borrowed trillions as people hid from Covid. We did as we were told and spent it all.

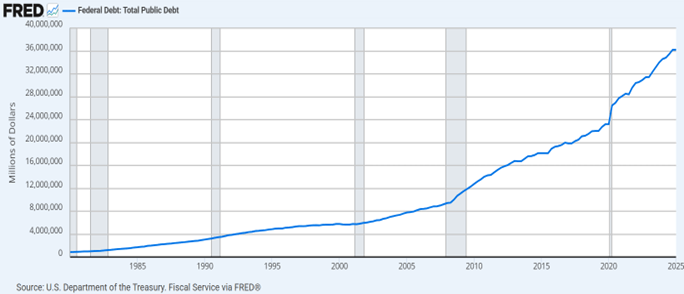

These actions were financed with borrowing. Trillions of dollars of debt.

Where is the parallel?

- The Catholic Church devalued virtue by making sin virtually free.

- Modern central bankers devalued thrift by making debt virtually free through near-zero interest rates.

Trust in the Catholic church plummeted, leading to a new form of religion called Protestantism. Protestants must live virtuously every day to be admitted to Heaven.

Trust in central banks and money has similarly plummeted today. A new form of protest (the root word of Protestant) is a new form of money called bitcoin, as well as the oldest standard of all, gold. Both are alternatives to paper money because neither can be printed.

Gold and bitcoin embody thrift and saving by their very nature.

Where To from Here?

Before we toss modern finance onto the bonfire of history, there is hope for reform. The year 1517 ignited the Reformation of the Catholic Church, much as bitcoin and gold are causing concern among bankers today.

It took until the 1545 Council of Trent for Catholics to get serious about curbing indulgences and training priests to prevent their abuse. Reforms then took another hundred years, leading to a more efficient and inspired church.

Today, we know excess debt is bad and grumble about it, but few governments – Canada, the US, Europe, China – have restrained their deficit spending. They will have to reform, at some point. Money can’t buy virtue. And debt can’t buy prosperity, either.

Image from Unsplash

Like Protestantism in 1517, bitcoin and gold will play a larger role in the monetary world. Gold is already reestablishing itself as the primary asset of many central banks and a Bitcoin Reserve has been proposed for a portion of U.S. reserve assets.

Both may form part of everyone’s portfolios in the future.

Tariff Bounce

It has been a remarkable run for markets since April 2nd - Liberation Day - when President Trump declared a tariff war on the world.

- Canada’s S&P/TSX is +21%

- The S&P 500 is +29%

Despite the fears of a global slowdown, the opposite has occurred. At least for the moment.

- Budgets were hiked to increase military spending and industry support to protect against U.S. tariffs. Canada alone has proposed moving defense spending from about 1.4% of the national budget to 5%.

- The AI boom has accelerated after pausing at the start of the year. Hundreds of billions are being spent on new data centres and nuclear facilities to power them.

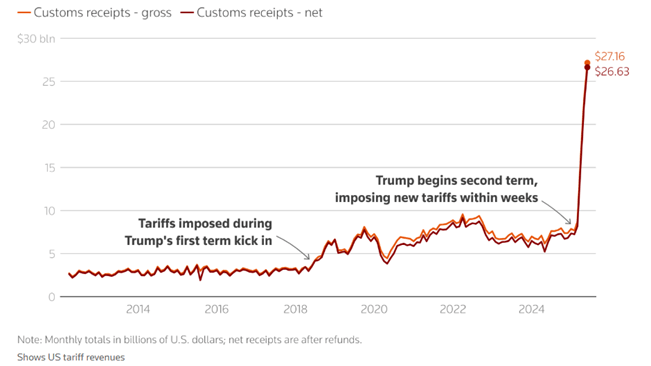

Orders that would have been placed later in 2025 were pulled forward to escape the tariffs. This caused a surge in business. U.S. tariff revenues have surged from $7 billion in May to $26 billion in June (source: Reuters):

While President Trump may claim these revenues as a bonus from evil foreigners, the truth is that they are simply a tax on Americans.

Recent business surveys, including one from Goldman Sachs, say tariff revenues are coming from the following sources:

- 49% U.S. consumers

- 39% U.S. businesses

- 12% on foreign exporters

Tariffs are a tax, nothing else. A national sales tax, not unlike Canada’s Goods and Services Tax.

As exports and businesses cut prices and consumers pull back on spending, the surge in revenues will flatten out.

July typically marks a slowdown in spending and money flows as people take vacations. Stocks also typically pause in the summer months.

A summer lull might just reveal the hidden cost of this rally: a tax quietly sapping American spending power.