Extinction Events

Written by Paul Siluch

June 24, 2025

Change happens. Sometimes fast, like with a meteorite or the pandemic.

Or slowly, like an ice age.

Either way, change is constant. And faster than ever, these days. We all know it. We all feel it.

There is no such thing as permanent success. Take the Hudson’s Bay Company. Founded in 1670, it was North America’s oldest continuously operating company until its demise this year.

Founded on the popularity of the beaver skin hat, the Hudson’s Bay Company once controlled 40% of Canada and had trading posts as far south as California.

Canadian Museum of History

Its iconic “point” blanket, with white, green, yellow, and red stripes, became a highly valued trade commodity for beaver pelts.

The number of small black stripes – points – indicated its size and cost in beaver pelts.

The Hudson’s Bay Company’s birth in 1670 predated both U.S. independence and Canadian confederation. It survived continental wars, Napoleon, and two world wars. It was once the sixth largest oil producer in Canada.

UBC Wiki

Unchallenged for a century, its first big threat arrived in 1779, when the North West Company arrived. Formed by rivals and former traders, North West delivered an entirely new business model that could have sunk the mighty Hudson’s Bay Company.

Think of Avon, Tupperware, and Amazon and what these upstarts did to existing retailers. They came to you – your living room or your mailbox - instead of you going to them.

The North West Company sent its voyageurs by canoe directly to the villages of the Indigenous trappers to buy their furs, instead of demanding the trappers come to coastal trading posts. By the 1790s, the North West Company had captured 78% of the Canadian fur trade.

The two companies skirmished in the forests and on the rivers, stealing forts and trade routes.

Finally, the Hudson’s Bay Company appealed directly to the British king and laid out the logic of continued monopoly. The two merged in 1821, with Hudson’s Bay claiming victory.

The company dominated Canada’s retail landscape over the next 200 years, buying competing chains such as Simpson’s, Fields, Zellers, Towers, Woodward’s, Kmart Canada, and Saks Fifth Avenue.

Big box stores arrived and began to weaken its hold. Woodward’s and Eaton’s were the first to fall. The Bay, as it was now known, responded with its own discount retailer called Zeller’s.

And then a meteorite called the internet slammed into the world. The Bay struggled to adapt. Sears Canada, Zellers, and even Target Canada succumbed to the might of Amazon and Walmart.

The pandemic shutdown in 2020 was the beginning of the end for the 355-year-old chain. Despite its deep roots, it was a weakened old tree full of decay and dead wood. It didn’t take much to push it over. Indebted, behind in its payments to maintain the escalators, it was obvious to anyone who shopped there that the end was inevitable.

The Hudson’s Bay Company declared bankruptcy on March 14, 2025.

Where Do I Buy My Underwear Now?

Biologists have a name for the hole left behind by extinction. They call it an evolutionary void.

But extinction for one organism is an opportunity for another. As Aristotle said, “Nature abhors a vacuum.” Empty spaces always get filled.

Other companies have already stepped up.

Lululemon, for example, was once just a small company specializing in women’s yoga wear. Today, they have broadened to clothing for both men and women, and even sell shoes. They are the new-age department store.

And they also sell underwear.

Down But Not Out

There are always risks in buying stocks when they are at their lows.

- Sometimes they are down and out. The tree is broken, even if you can’t see it yet.

- And other times they are bending in a storm. Bowed but not broken.

We have owned PepsiCo for years. Known for its signature cola and other sodas, PepsiCo’s revenues are 60% food and 40% beverages. It is the king of potato chips through FritoLay, with close to 60% market share in the U.S. (Zion Market Research).

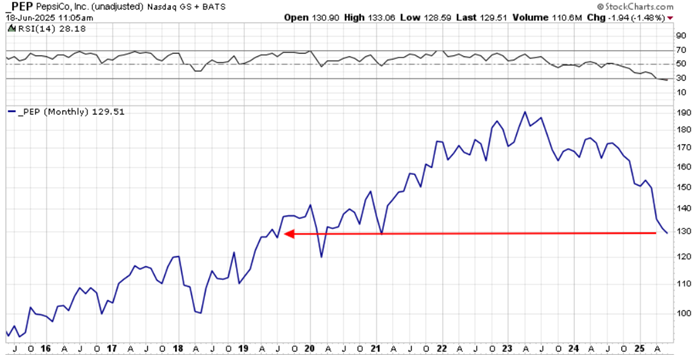

The stock is trading at the same level as it was in 2019 – six years ago – even as profits and the dividend are up 50%. The shares have declined from $190 to $130, hit by struggling consumers, an increasing aversion to junk food, and a new drug called Ozempic.

Is Pepsi finished, like the Hudson’s Bay Company? Will people never eat salt and sugary foods again?

Hardly. Pepsi has diversified into healthy snacks (Quaker Oats, Aquafina, Bubly, Tropicana juice, SodaStream, Sun Chips) as well as energy drinks (Gatorade). Their goal is to have 75% of their food portfolio with low sodium and salt, and 67% of their beverages with low sugar (PepsiCo annual report).

People still want packaged convenience – with a healthy aspect – and Pepsi delivers.

Food stocks like PepsiCo outperform when the economy slows, and with unemployment rising and manufacturing sputtering, we are seeing signs of slowing.

Pepsi should outperform again someday. We don’t know when, but we think we are close.

Markets and Wars

Newspapers sell more when wars scream out from page one. We are drawn to the chaos and terror of battle.

And yet, markets tend to shrug wars off. The Russian invasion of Ukraine happened in February of 2022, which sent stocks lower. But interest rates started their steep climb from 0% in January of 2022 to 5% by 2023. Was it the war or interest rates that hurt stocks?

Markets were at new highs by early 2024. The Middle East has been embroiled in conflict, from Gaza to Syria, since 2023, and markets have almost completely ignored them.

In general, markets accommodate geopolitics quickly. That’s because stock prices are determined by interest rates and profits mostly.

- High interest rates hurt profits. Low interest rates help.

- Tariffs impede trade and hurt profits.

Interest rates are pointing lower, even if grudgingly, and stocks are looking forward to easier credit conditions. Both Canada and the U.S. are expected to cut rates further this year.

And stocks price off profits. Earnings for the first quarter of 2025 were surprisingly good, especially in the U.S. Could it be front-running to avoid tariffs? Maybe. Or possibly the tariffs won’t be as bad as we fear.

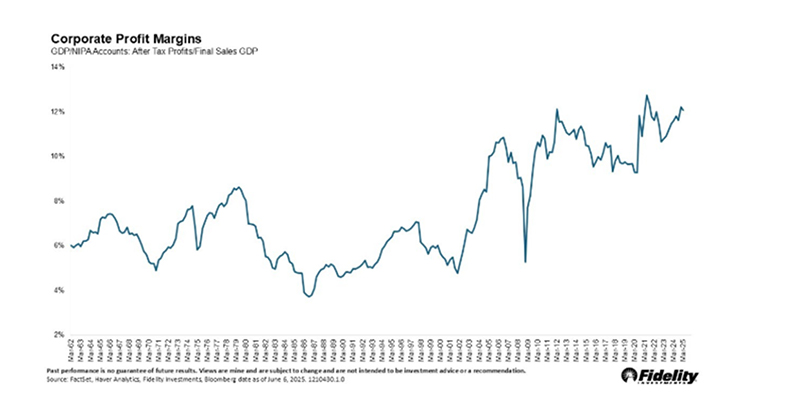

One of the biggest worries today is that stock valuations are high compared to history.

What is not generally known is that today’s companies are significantly more profitable than they were 20-25 years ago. They make more money with fewer people.

Denise Chisholm, Director of Quantitative Market Strategy, Fidelity Investments

Oil, gold and bitcoin all surged this week due to the Israel-Iran hostilities. These appear to be cooling off now, which suggests a more limited conflict than feared.