Give Peace a Chance

Written by Paul Siluch

August 21st, 2025

Give Peace a Chance

- John Lennon

President Trump is determined to end the war in Ukraine. He may be premature in his enthusiasm, but the fact remains that both sides are exhausted. Russia has suffered over one million casualties and Ukraine perhaps a third of that. Russia’s budget deficit is 30% higher than expected and the government has hiked income taxes sharply in response (data from Kyiv Independent).

Both would benefit from a ceasefire, even if they are too proud to admit it. And while we may not be able to plan on a peace settlement, we can at least start planning on a plan for a peace settlement.

"This is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning."

- Winston Churchill

America entered WW2 in December of 1941. The Dow Jones Industrial Average hit bottom in January of 1942 and then, never looked back as it doubled by late 1945.

With victory declared, markets slumped from 1946 through 1950, when they started a new bull market.

An unfortunate reality is that spending on conflict can be very stimulative for certain parts of the economy:

- Governments have the political freedom to borrow, and they do it aggressively.

- The entire supply chain of manufacturing, from mining to finished machines, gets energized.

- Factories run 24/7 and jobs are plentiful. There is an insatiable demand for wartime supplies.

However, peace brings a whole new set of challenges.

“The greatest danger occurs at the moment of victory”

- Napoleon Bonaparte

It would be wonderful if a ceasefire were achieved in Ukraine. However, there are market implications of peace. We may be starting to feel those changes now, and they come at a time of year when markets are at their weakest.

Commodities Could Suffer

Russia is a breadbasket of everything from fertilizers to refined uranium to oil. All of these have been under heavy sanctions since war broke out. If Russia agrees to peace in exchange for a lessening of sanctions, there could be a glut of commodities now free of penalties hitting markets. Globally, we are still undersupplied in everything from silver to uranium to rare earth metals, but this could depress prices until the excess is absorbed.

Fear Recedes

There has been a substantial ‘fear trade’ since 2022. This encompasses gold, bitcoin, natural gas in Europe, and refined uranium. If the world is suddenly less afraid of world war or inflation subsides because oil prices drop, will there be less demand for these particular investments that have been driven higher as a result? It is a possibility.

Sector Rotation

During conflict,

- commodities

- manufacturing

- armaments

- technologies related to defense (drones, artificial intelligence)

…get all the money. Spending on artificial intelligence has gone through the roof, and some of this has come from the military.

“The problems of peace are greater than the problems of war.”

- Billy Graham

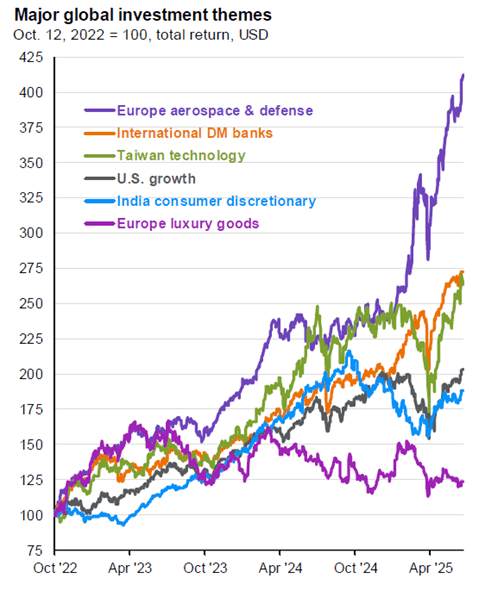

When peace arrives, people switch their focus. Sectors such as travel, housing, clothing, and entertainment become important once again. Since 2022, sales of luxury goods in Europe have been flat while defense spending has gone vertical – see below.

JP Morgan

Even a small shift in spending from wartime to peacetime could impact both sectors.

It may be early, but it is worth thinking about peace and the turbulence it can bring for investors.

Is a Trust for You?

The word “trust,” in legal terms, can be traced back to the time of the Crusades.

When knights headed off to liberate the Holy Land, they were often gone for years at a time. They needed their estates managed and their families supported, so they found a trusted friend or relative and transferred legal ownership of their property until they returned.

Hence the term, “held in trust.”

Because trusts were new and ambiguous, some ‘trusted’ relatives refused to give the land back when the knight returned. The most famous example of this was when King John tried to steal the English crown from Richard the Lion-Hearted who was off saving Christianity. The future “Bad King John” had to flee to France when King Richard showed up, but he inherited the throne years later anyway. He was as cruel and greedy a king as he was a trustee, leading his barons to eventually rebel and force him to sign the Magna Carta.

This practice of stealing “in trust” properties occurred often enough that King Henry VIII had to enact laws in 1535 to protect beneficiaries from grasping trustees (Statute of Uses – English Law)

From these unsavoury beginnings, the modern trust evolved, where one person acts with loyalty, care, and prudence to administer property for someone who cannot do so themselves. Trustees today are held to a very high standard, with legal ramifications if they do not follow the explicit instructions of the Trust Deed.

A formal definition is as follows:

A trust is a legal relationship that can "own" assets and includes instructions for whom you want to handle your affairs and whom you want to receive your assets during your incapacitation or after you die.

- BOK Financial Advisory Trust Services

We are seeing interest in trusts increase, as family dynamics change. Why?

The standard Last Will and Testament – which works well for most people – can be easily challenged in court and changed against your original wishes. Trusts are often used instead.

Here are a few examples of when a trust is useful:

- Significant wealth in the family – You may want your assets to last longer than one generation, and to be distributed according to your wishes, years later

- Complicated assets – Private companies, business interests, real estate

- Multiple marriages – Making sure each side of the split family gets their proper amount

- Minor children

- Incapacitated adults

- Adult children unable to manage their own affairs

- To protect assets from lawsuits

- Privacy – All assets in a trust are shielded from the public

- Prevent probate – Wills pay probate fees where trusts do not

- Tax benefits – Some elements of income splitting are possible

Sadly, some of our clients’ children lack the health or discipline to handle money. Trusts are used to manage and apportion an inheritance over the years, ensuring it lasts a lifetime.

Raymond James Trust is able to act as trustee, and then our team manages the money for a number of people in this situation. Our focus on dividends and income is ideal for trusts.

And because of the increasing interest in trusts – and the complexity – I enrolled in the Trust and Estate Professional (TEP) series of courses. This will take about two years to complete.

I’d be lying if I said it was easy – it isn’t. But it is important knowledge our clients need.

Call for a discussion if you think this might apply to your circumstances.