The Gambler Inside All of Us

The Gambler Inside All of Us

By Paul Siluch

To sin, or not to sin…

It’s a quandary we've all been in,

Smoking, drinking, even pot

Such fun today, tomorrow not.

Hell was once, the preacher said

Where kissing, drinking, smoking led,

Lotteries are now considered nice

Encouraged just like every vice.

I worry, though, if I stay chaste

How will the taxes be replaced?

There’s nothing left from what we made

And debts demand that they be paid.

I don't smoke, perhaps I'll start

It's a way to do my part,

The tax I’ll pay will help impart

New ads to tell me not to start.

I’ll play some cards and roll the dice

A loss would be my civic price,

I’ll up the rate I do my drinking

It’ll help to slow my rate of thinking.

Now laws have changed, and I must heed

Our nation’s need to sell some weed,

It's safe, it's good, our northern pot

Now legal, too, in case you're caught!

The logic here is clear to see

We need to heed our leaders’ plea:

"Don't you start, but don't you quit"

For who will pay the deficit?

- Paul Siluch

Have you ever bought a lottery ticket? And then wondered why as you tore it up after losing?

Humans are attracted to risk, and a few take it too far through gambling.

Somewhere at the bottom of our lizard brains, there is a pleasure centre that gets stimulated by the thrill of taking a risk, followed by a rush of endorphins, adrenaline, or dopamine (pick your favourite reward chemical) to deliver an even bigger rush when it pays off.

The actual place is called the nucleus accumbens, for those who know their way around their grey matter. It plays a role in reward stimulus and delivers dopamine when we indulge in risky behaviours.

Risk isn’t the only reason we gamble, of course. We roll the dice to escape boredom if our lives are dull. We do it to be social. Some do it because they see no way upward except through blind luck.

Either way, gambling is nothing new. We see it referenced in both Roman and Chinese history, and dates back to our cave-dwelling ancestors; we’ve been carving bones for games for close to 5,000 years. It took the Italians to take it to the next level, however. In Renaissance Italy, the city of Milan used a lottery to fund its war with Venice, and then continued on financing roads and bridges after the war was over.

As any gambler will tell you, it’s a hard habit to break. And it’s a slippery slope for governments once they get used to the money.

Here in Canada, we started gambling on horse races in 1767, allowed bingo for charity in 1900, and legalized lotteries in 1969. In 1974, when the Montreal Olympics got the gold medal for crazy spending when the Montreal Olympic stadium went over budget by $1.4 billion, the government authorized the first national lottery (Loto-Canada) to pay it off. Every province followed with a provincial lottery by 1976, general gambling was legalized in 1985, on-line gambling became ‘game-on’ in 1994, and now sports betting has become legal as of 2021.

I have no idea what comes next to place bets on in the future, but they will think of something.

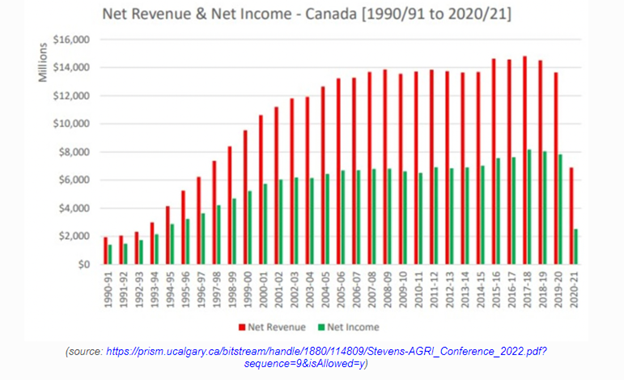

In total, gambling is now a $12.5 billion revenue generator in Canada (History of Gambling in Canada – reviewlution.ca). The University of Calgary graph below shows it above $14 billion.

Winner, Winner, Chicken Dinner

I was reminded about lotteries when a friend gave me a ticket recently. She found $5 on the street and decided to be generous, so bought five tickets and gave them away. Mine ‘won’ me a second ticket, which triggered my nucleus accumbens reward centre, only to feel it deflate when I lost on the additional try.

I began to wonder what my chances really were, and what the size of the business is here in British Columbia.

Turns out, it’s pretty big.

In 2018-19, B.C.’s gross gaming revenues were almost $2.6 billion. The government ended up making $1.3 billion in net profits after winnings and costs were paid (source: BC Government budget).

$1.3 billion is about 2.3% of total BC government revenues and is now larger than tobacco taxes, forest royalties, oil and gas royalties, liquor taxes, or fuel taxes. And gaming continues to grow, after the brief pause called “the pandemic” when all casinos shut down.

The government has always promised us that gambling revenues go back to charities and the public good. But is that still true? I mean, once you get hooked on a sure source of money, do you still give it all away?

One line in the BC Budget says “Government will distribute approximately 25 per cent of its gaming income to charities.” 25% is a lot less than 100%, so there you go. Government needs the money, so it now keeps most of it.

Think about this for a moment. $2.6 billion in gambling revenues over 4.3 million adults in B.C. equals $600 per person in gambling losses every year. Sure, there are a few winners so the net cost is lower, but do you spend this much?

I don’t. Why? The odds of winning the largest, Lotto Max, are 1 in 28.6 million. That’s 1800x lower than being struck by lightning. It is better with other games, but you are still statistically guaranteed to lose.

Even Gambling Needs to Evolve

Despite gambling being a growth business, like many other industries, it is being affected by changing generations. If you have ever visited a casino, it is similar to what you see at most libraries, symphonies, and bookstores: gray hair everywhere. Same for lottery ticket sales. It turns out millennials aren’t that interested in lottery tickets - they want quicker action and fast rewards. No waiting until the Friday draw.

In Ontario, the Ontario Lottery and Gaming Corp. recently reported that “just seven per cent of adults under 35 play the lottery at least once a week, compared to 45 per cent of all adult Ontarians.” (source: CBC)

So what is a gaming system to do?

The first thing lotteries did was reduce the odds of jackpots so the ultimate payoff grew until just one grand prize winner was announced. Mammoth “Powerball” payouts sell more tickets, even as the odds drop. Then, they unveiled “scratch and win” tickets that offer instant gratification and many smaller $1 to $20 rewards – most of which get plowed back into more tickets.

The future of gambling, however, lies is e-gaming. Modern youth was raised on video games and the fastest-growing segment is on-line gaming on your phone or computer. It is now a $58 billion market globally and growing at 12% a year (source: GlobeNewswire). Sports betting (“e-sports”) is still small, but growing even faster. Sports betting is a key area of growth because it targets an even younger demographic.

Investing versus Gambling

Gambling has brought our family together. We had to move to a smaller house.

- Tommy Cooper

I have never been much of a gambler. I went to the local casino a few years ago, lost $10 on the slot machines, made $14 with one lucky pull, and cashed out. I am not their ideal client.

An urban myth says that most big lottery winners go broke in a few years. Turns out that isn’t true. Recent studies show that people who win big prizes tend to feel more satisfied with life and enjoy their winnings. My own observations are slightly different. I knew one fellow who won about $500,000 and became obsessed with the options market to make more. He lost it all and became a recluse. Another won $3 million, quit his job, and lived in fear of losing it. Sudden wealth is not the same as gradual wealth, at least to my way of thinking.

Lotteries and roulette are games of pure chance. There is no skill involved, so don’t pretend there is. What is involved is risk. A hedge fund manager I follow assesses risk as follows:

At the bottom of a swimming pool is a $1 million gold coin. The pool has sharks in it – the more sharks, the lower your odds of making it back to the surface alive with the coin.

With lottery tickets, it is not a pool with a few sharks – it is all sharks in a few drops of water. There is almost no way to get the gold coin.

What about poker and blackjack? These games do involve some skill. Card counting, a good grasp of probabilities, and an eye for reading opponents are traits that help a few actually become winners. At least some of the time. It is the “House” that wins consistently, however. The odds are always stacked in the dealer’s hands.

Which brings us around to that other risky business: investing. The stock market engages the same pleasure centre of the brain when we win, as well as the “fight or flight” response when we lose. Except our odds are better. The prize is smaller - we aren’t looking to make millions on a dollar invested in a single ticket – but our probabilities are far better. There are far fewer sharks in the pool, in other words.

Investing in established companies with a diversified portfolio is as close as you will come to being the House in gambling, where the odds are in your favour. Stocks have risen in 69% of calendar years since 1871 (source: Robert Shiller, Yahoo Finance), which is as good as any casino house odds.

But chaotic markets like these can feel more like gambling than investing. We have a wide array of random events crashing together – wars, interest rates, politics, bank runs – that completely upend all the good that companies do by themselves.

All we can say is: hang on. The U.S. will find agreement on their debt ceiling because they have to. Governments will find a way to save the U.S. banks because, again, they have to.

One definition of luck is ‘preparation meeting opportunity’. Canadian banks, energy, fertilizer, mining, and technology stocks are all on sale right now. It is common to hear people say “if I had only invested when stocks were down.” We are closer to “down” than we are to “up” these days, so be prepared to go bargain hunting.

Charlie Munger, Warren Buffett’s partner, said this recently:

“Invest shrewdly. If you don't, you're going to need a lot of luck. And you don't want to need a lot of luck. You want to go into a game where you're very likely to win without having any unusual luck."

Rejected at the Altar

Canadian banks are like big fish in a small pond – there is only so much room for them to grow north of the border. All of them have pursued strategies to grow outside Canada, with all of the Big 5 but Bank of Nova Scotia looking south to the U.S. market. Bank of Nova Scotia operates heavily in the Caribbean and Latin America.

Royal Bank completed a large acquisition last year and Bank of Montreal is just closing on its purchase of a U.S. regional bank. TD was inches away from absorbing First Horizon Bank in a US $13.4 billion deal just as every regional bank began to suffer from high interest rates. Citing regulatory delays, TD Bank paid a $200 million break-up fee and walked away.

Canadian banks are experiencing growing deposits even as the U.S. banks are losing theirs. It could put them all in a good position for the year ahead – TD Bank most of all - because there are, suddenly, bargains everywhere.

The CET1 ratio is a measure of the capital position of Canadian banks. The bigger, the better, meaning it has more money to buy smaller rivals. The minimum for Canadian banks has been raised to 11% as of late 2022:

11.5% Bank of Nova Scotia

11.5% Bank of Montreal (was 16.7% before its latest U.S. acquisition)

11.7% CIBC

12.6% Royal Bank

16.2% TD Bank (would have dropped similar to BMO)

(source: Statista)

Sometimes the best bets are the ones you don’t make. TD Bank now finds itself with the highest capital reserves of every Canadian bank right at the moment of the biggest sale on U.S. regional banks in a decade.

Our Dividend Value portfolios hold TD Bank shares.