The Value in Value Investing

Written by Paul Siluch

December 19th, 2025

This week’s letter is a little different

The world is fully in love with AI and the hyper-growth of chips and data centres that have gone with it.

TIME Magazine even selected AI as its ‘person’ of the year for 2025.

Instead, I decided to interview an investment manager at the other end of this spectrum: the value end.

Value investing is the opposite of new and popular. It is:

- buying things on sale

- finding value no one else sees

- seeking companies in temporary distress

The idea of intrinsic value was formalized in the book Security Analysis in 1934 by Benjamin Graham and David Dodd. Warren Buffett and Sir John Templeton were both students of his and went on to popularize value investing.

The History of Value Investing

The 1960s was a decade of growth. Fifty popular growth stocks came to be known as the Nifty Fifty because all you ever had to do was buy and never sell. Examples included:

- Polaroid

- Kodak

- McDonald’s

- Coca-Cola

These were crushed in the bear market of 1973-74 and underperformed the broad index for the next decade (intrinsicinvesting.com). Most recovered nicely by 1994 (20 years later), although some never regained their pre-crash highs.

They were the MAG 7 stocks of the day.

Charles Brandes was a young stockbroker in 1971 when he met Ben Graham. He became an ardent advocate and started his own mutual fund in 1974. He never looked back.

1974 was the perfect time for a value investor because so many companies were forgotten and cheap.

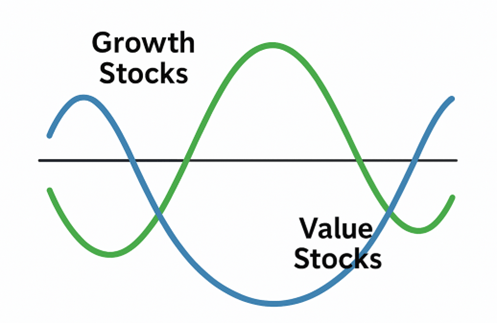

Value and growth investing move in cycles of 7-8 years. New industries come along, like computers in the 1980s or the dotcoms of the 1990s. These rise while everything else is ignored.

Then a recession hits and value investing returns - what is old is new again.

Value investing had its last bull-market cycle from 2000-2008. This was after the dotcom growth stocks crashed and China was gobbling up every commodity in the world.

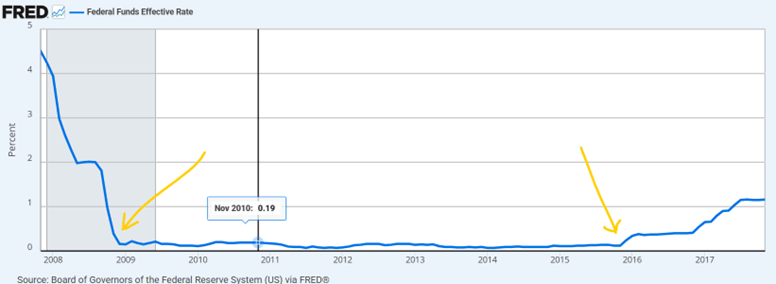

The value wave ended in 2008 with the Great Financial Crisis. Governments around the world cut rates to 0% and held them there for seven years - far too long.

The era of 0% interest rates helped technology and other growth stocks recover and then go far beyond recovery. This spurred first, a new growth cycle, and then a technology mania that lasted from 2010 until now. 15 years is far longer than the typical cycle.

Value investors? Their world shrank. Dedicated value managers quietly added growth stocks to their portfolios just to survive. This is called style drift.

“I used to be Snow White but I drifted.”

– Mae West

Interest rates at 0% meant companies – and people – could borrow at extremely low rates for almost anything. And they did.

- cryptocurrencies

- meme stocks

- NFT’s (non-fungible tokens)

- cannabis

- social media

- streaming stocks

…anything with rising revenues could be financed, whether it was profitable or not. Slow-growing companies were ignored.

Today, we see AI companies of every size able to raise money with no business plan or path to profits.

Because most indexes are weighted to the biggest companies, the top 10 stocks now make up about 41% of the S&P 500 index.

The remaining 490? They make up just 59%. Traditional banking, defense, heavy industry, and commodity companies have languished, all but forgotten.

Growth outperformed value by a wide margin from 2012 through 2022, as measured by the Vanguard Growth ETF versus the Vanguard Value ETF (StockCharts):

+240% Growth cumulative return (11.8% annualized)

+163% Value cumulative return (9.2% annualized)

However, the tide may be changing. Interest rates have risen around the world and inflation is running hot. Rising prices are good for value-oriented companies – growth stocks have still outperformed value over the past two years, but value is catching up. Dedicated value managers like Brandes have outperformed, but few people have noticed.

If the typical cycle is 7-8 years, then a new bull market in value stocks is still young.

Different Flavours of Value

I spoke at length with Pranav Jaiswal (PJ, as he is known), the director of Private Client Portfolio Management for the Brandes organization.

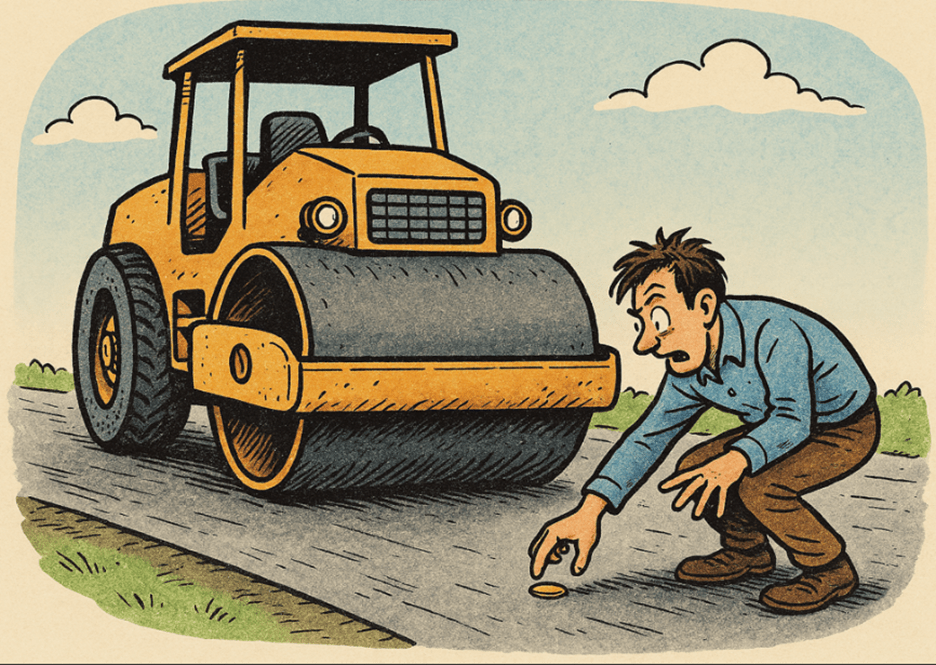

Brandes once focused solely on deep value. Companies worth more broken up and sold for parts.

This is called the “picking up dimes in front of a steamroller” strategy.

Sometimes you keep the dime. Sometimes the dime is just too dangerous to reach for - the risk is just not worth it.

PJ said Brandes learned this hard lesson in 2008 when the undervalued banks and auto companies it owned went bankrupt. No one would lend to them. Managers owning these “dimes” found they were worth pennies.

Brandes now uses three separate value methods together:

- Deep Value – very cheap companies that are in trouble.

- Secondary Value – cheap companies with average balance sheets.

- Quality Value – great companies that are temporarily on sale

Deep Value is the riskiest. These are companies often close to bankruptcy, or whose industry is in peril. Think of Polaroid when digital cameras appeared, or lumber companies today suffering under heavy tariffs.

Secondary Value includes average companies trading cheaply. They aren’t distressed, but they may exist in weak industries, like cement companies and homebuilders today.

Quality Value are companies with good growth and strong balance sheets but are down for political or temporary reasons. Today, Brandes Global owns global technology companies such as Alibaba in China and Taiwan Semiconductor in Taiwan – both victims of uncertain geopolitics.

Why Value Now?

Government stimulus from 2009 through 2020 came through monetary stimulus. Central banks pushed daily rates to 0% and bought bonds to force mortgage rates down. The hope was that low rates would stimulate borrowing and new production.

It worked, sort of. But monetary stimulus also helped drive up debt and asset prices, such as houses. It didn’t help job creation or wages.

Today, governments are stimulating again but through fiscal measures. Deficit spending. Europe is rearming and reindustrializing. Same in Japan, America, and Canada. Deficit stimulus goes directly to companies, many of them the kind of traditional value companies value managers own.

Safety in Value

The growth leaders of the 1960s - ITT, Teledyne, Gulf+Western – had very high growth rates. Same for the dotcom darlings of the 1990s. And then it stopped.

Many growth stocks of both these eras declined between 50% and 90% when the bear market hit.

Meanwhile, value stocks hardly budged in the market decline.

Why? One of the biggest reasons for owning value stocks is that they are already down. They were never overvalued to begin with.

“Falling out of a basement window” means declines tend to hurt less in value stocks.

Where are the values today?

First, international stocks trade at much lower valuations than their counterparts in the US market. Chevron is more expensive than Total Petroleum, for example. Even though they do almost exactly the same thing. Same for Proctor & Gamble in the U.S. and Unilever in Europe.

The Brandes Global Equity portfolio now holds about 60% international and 40% US. They are underweight the US today because the United States captures 65% of the global stock market index yet represent just 5% of the world’s population. These outsized numbers tend to revert to the mean over time.

Brandes had been overweight in Japan and China but have been taking profits as these markets recovered. India is intriguing but they remain underweight.

Second, the biggest winners from Artificial Intelligence may be the users of it rather than the providers of it. Traditional value companies may be those big winners.

For example, AI is making drug discovery and drug testing much, much faster. This is a huge benefit to pharmaceutical companies. And this is not expected at all – the drug sector trades at close to 30-year valuation lows.

Banks like JPMorgan are using AI to improve lending and credit scores. UPS, the parcel delivery company, has saved millions by using AI to plan better routes. Deere uses AI to differentiate between crops and weeds during drone crop spraying.

Third, some countries have been hit hard by the U.S. tariffs. Brandes is moving money towards Latin America. Mexico, for example, fell hard when President Trump imposed harsh tariffs and the country elected a socialist president. Mexican stocks were punished harshly.

Meanwhile, companies that sell locally, like Kimberley Clark Mexico and Wal-Mart Mexico (Wal-Mex), benefit from Mexico’s younger population. Once relations improve with the United States – and they will – they will be big beneficiaries.

This generally applies to all Latin America.

What is unloved today?

I remember being on a conference call with Charles Brandes around 1999. His three biggest portfolio holdings:

- Service Corp ( a funeral chain)

- Lockheed Martin (armaments)

- Waste Management (garbage collection)

…were down and cheap while Cisco and the dotcoms were flying. It was a tense and angry call, but Charles Brandes held his ground.

A year later, he was proven right in a very big way. These stocks doubled and tripled when the dotcoms crashed.

I asked what PJ what Brandes would be defending today if we were on that same call in 2025. Here are today’s biggest holdings:

- Health care. Brandes Global has 24% of the entire portfolio in health care stocks. They are depressed because vaccines are under fire, drug patents are expiring, research has yielded too few new drugs, and the US president is pressuring the industry to lower prices. All of this is known, however. Prices are already down. Yet pharmaceutical companies could become some of the biggest beneficiaries of AI.

- Financials. Banks are inexpensive compared to the rest of the market. Banks make money when people borrow and grow businesses, neither of which is happening right now. But balance sheets are solid and there is a push by governments to lend more. And for the record, they own no Canadian banks. US banks trade at about 1x book value while Canadian banks are 3x book value. European banks are even cheaper. Canadian banks are great, but they are priced accordingly.

- Low technology exposure. Brandes owns just half the market weight in technology stocks, which is a big bet. Thanks to technology stocks, the US makes up 65% of the world stock market weight yet has just 5% of the world’s population. That may revert in the decade ahead. It has in the past. The technology stocks Brandes does own are mostly located overseas.

Conclusion

Value stocks have had a good two-year performance run. If past cycles of 7-8 years of outperformance repeat, then value still has a long runway.

US dollar weakness and inflation help value stocks and international markets. These were once headwinds to value. Now, they are tailwinds.

We lean towards value stocks in our Dividend Value portfolios. If you own growth managers or index ETFs, you could benefit by adding an active value manager like Brandes for what is ahead.

None of the stocks mentioned here are meant as recommendations.