Should I Stay or Should I Go?

Written by Paul Siluch

November 28th, 2025

Should I stay or should I go now?

If I go, there will be trouble

And if I stay, it will be double

So come on and let me know

Should I stay or should I go now?

- The Clash, 1982

In 1982, a band called The Clash published a song about the lead singer’s struggles with a girl, as well as the possibility that he might leave the band.

Mick Jones, the lead singer, left the band in 1983. He should have stuck around. The song Should I Stay or Should I Go – a modest hit in 1982 – was featured in a Levi’s jeans commercial in 1991 and rocketed to #1.

Should I Go?

This is a question we get a lot, these days. Not about girls, though. About staying invested in the stock market after such a long rise.

There is merit to both sides of the argument.

- Valuations are high, particularly in Artificial Intelligence (AI) related stocks.

- This rally is getting long in the tooth. It began in late 2022 when the Dow was at about 28,000. It is 48,000 today.

- Global economies are slowing, as evidenced by increasing layoffs and rising deficits.

- President Trump’s policies are erratic at best and protectionist at worst. Free trade is a thing of the past.

But there are also positives:

- Outside of the top 10 AI stocks, the broad market is much more reasonably priced.

- Interest rates are declining, which normally helps stock prices and the economy.

- Steep drops every few years are normal, and we just had one in April. That was only seven months ago, meaning this could be a young bull market.

- Stock prices follow earnings. Earnings are rising. Governments everywhere are spending to rebuild.

“Over 80% of S&P 500 companies have beaten earnings expectations, the highest beat rate since the second quarter of 2021. In total, Q3 earnings are coming in at over 10% above analyst estimates, which is the highest upside surprise we’ve seen since Q2 2021.”

- Charlie Bilello

The Worst Month That Wasn’t

October is normally the month when bad things happen, but we didn’t get the Hallowe’en scare we often get. Instead, the decline waited until November – we have just experienced a -5.7% drop.

Is this a big deal? Not really.

Most years see up to three -5% declines every year, on average (Advisorpedia). This means we experience about 30 declines of -5% in a decade.

Every shock like this feels like the end of the world, even as stocks end the year higher in most cases. In 73% of years since 1926, stocks have risen (Dow Jones data).

Wired for Loss

Daniel Kahneman and Amos Tversky published a study on loss aversion called Prospect Theory in 1979. Their paper showed people feel losses about 2-3 times more intensely than equivalent gains.

The study was repeated around the world, finding exactly the same response in every country.

Losing $1 feels much worse than winning $1.

And if psychologists know we feel pain more than gain, you can bet the algorithms directing social media do too. We are fed more negative news because our eyes go to stories about loss more than stories about gain.

We see this bias towards loss aversion in the business media.

A study by the U.S. Federal Reserve on unemployment coverage from 1980-2019 in major papers like The Wall Street Journal showed about five more negative articles per month than good news stories (federalreserve.gov).

In "Government & Economy" topics, stories about losses (market crashes) outperformed gain-framed ones. Pew surveys show 2-5x more emphasis on downturns (National Institute of Health).

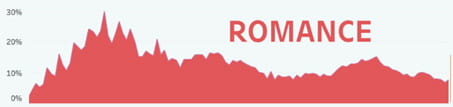

Anecdotally, we even see this in the films we watch. These charts date from 1910 to 2020. Over the last two decades, new romance and comedy movies have been flat or in decline. They all inflect around 2000, when the internet began its boom.

Happy movies declined:

While fearful movies gained popularity:

Film Genre Popularity 1910-2021 (data is beautiful, Reddit)

For those of us who are fans of science fiction, this has been even more pronounced. We see more stories of bleak futures in science fiction now than we did decades ago.

I asked Grok AI to summarize the science fiction films by decade and it showed the following:

1950-1979: 80-90% resolve with positive progress

1980-1999: apocalyptic/dystopian futures ~25-30%

2000-2020: dystopian/post-apocalyptic futures ~40-50%

The summary also stated that the trend accelerated after 2010. What happened in 2007? The iPhone was unveiled, ushering in the modern era of social media.

Caution in Markets

This is not to disregard revered investors like Warren Buffett who are holding extra cash these days. Berkshire Hathaway has built cash to almost 31% of its investment portfolio. Buffett often raises cash when valuations get elevated and he is waiting for something to happen.

Berkshire Hathaway is also an insurance company that must hold a buffer of cash for “1 in 200-year events.” And Warren Buffett is stepping down, so the current high cash level may be his way of handing a clean slate to his successor. Other insurance companies like Allstate hold only 8% in cash reserves (Macrotrends).

Is he right to worry?

The AI boom is likely in for a period when these stocks come back to Earth. We are already seeing the group spreading out in terms of performance. Meta (Facebook) and Oracle are trailing while Alphabet (Google) leads.

For all of them, spending is off the charts. It is unsustainable in the long term.

As the economist Ben Stein said, “If something cannot go on forever, it will stop.” So, if you are over-exposed to the leading AI stocks or U.S. indexes heavily-weighted to them (the S&P 500 was 41% weighted to the top 10 AI stocks at the peak), trimming is not a bad idea.

Trimming is not selling, however.

Should I Stay?

Selling everything is almost always a bad idea and should only be reserved for when you are dead.

Selling is actually two decisions: selling now and then getting back in. Over my career, I have seen people sell everything. I have never seen them buy it all back. These people end up stuck in cash when markets rise, and they are inevitably poorer for it.

The other thing to remember is that many sectors are already in bear markets.

- Staples (food) peaked in 2024

- Energy peaked in 2024

- Materials peaked in 2024

Some have been in slumps for a few years:

- Real estate peaked in 2022

- Department and specialty stores peaked in 2022

And a few are real laggards:

- U.S. telephone companies peaked in 2016

- Pharmaceuticals (drugs)peaked in 2015

Pharmaceuticals are still trying to get back to the highs set in the summer of 2015.

The S&P 500 has returned about +9% per year over the last three years. Excluding technology highlights underperformance in the broader market.

If we take out the top 10 technology stocks from the S&P 500, what is left has returned just +3-3.5% in annualized returns (S&P 490 - LPL Financial data).

After similar periods when most stocks lagged during a technology boom, such as the 1960s and 1990s, these stocks played catch up in the following decade. The 1970s were known for inflation and poor markets. For Canada, the 1970s were great years to invest as the world built and used what we produced.

Canada is now prioritizing resources and national infrastructure. It reminds me of the 1970s all over again.

To Summarize

We live in an environment soaked in negative news. Most headlines are written to inspire fear and action, two things not always in your best interest.

The best strategy is the one you can stick with. Do your companies have a solid market position? Are your dividends growing every year? Hang on to them.

The price of admission to gains in the market is an occasional decline. If something gets too big and you are uncomfortable, trim it back. Just remember, though, stocks grow because they are doing the right things. You don’t want to sell all your winners.

“Doing nothing is the best investment decision most of the time.”

- Ben Carlson, “A Wealth of Common Sense”