The Prediction Game

Written by Paul Siluch

January 16th, 2026

It is that time of year when we make resolutions about how we will be better this year than last year. It is also when economists, journalists, and soothsayers make predictions about the year ahead. Both end up in the trashcan by February.

“Predictions are hard, especially about the future.”

- Niels Bohr (physicist)

In 1999, a chimpanzee named Raven picked 10 internet stocks by throwing darts at a board out of a list of 133 companies.

Raven returned 213% in 1999. His portfolio became known as the MonkeyDex index.

“Our hero had no strategy, no idea of the market’s modus operandi, and no idea what the Nasdaq even was – yet he outperformed over 6,000 finance pros.”

-Guiness Book of World Records

It was a marvelous demonstration of luck, randomness, and diversification. Talk about making fools of the experts.

For those of us not as lucky as Raven the money, the predictions business involves either forecasting the boring (but safe) long-term average, or claiming something so outlandish, it makes you briefly famous. Few remember if you are wrong, but if you are the Raven of the year, you are now a sage.

For the record, Raymond James predicts a 5-6% return in 2026 for the US market. That would be a safe and boring guess.

Other firms have targets much higher, while some are much lower. Getting it right is really just a guess.

Instead, let’s look at a few trends that are in place as we enter 2026. These are trends, not predictions, so easier to follow. Like inertia, trends in motion tend to stay in motion.

Here are some that should persist, at least for a few months:

The positives:

- Profits in the U.S. are accelerating and the economy is, on the whole, expanding.

- Growth is concentrated in the technology and AI sectors, but these are pulling the nation with them.

- Demand for electricity, generators, military equipment, mining machines – big stuff – is rising. Commodity prices are also increasing due to demand. Good for Canada.

- Interest rates should remain flat or continue to gradually decline. Inflation is moderate thanks to low gasoline prices.

- Valuations are still high, but not as bad as they were. Earnings are going up, justifying higher stock prices.

- Could Artificial Intelligence usher in a new boom in productivity? AI is already driving higher growth and higher earnings through more output with less labour.

- The policies of the White House have not yet resulted in economic harm.

The negatives:

- Investors are too bullish. Cash reserves are low, and margin debt is high. These often precede corrections.

- The full impact of AI on the job market, corporate profits, and accelerating spending has yet to be felt. Does it help or hurt society? Unemployment is up, but only modestly so far.

- China is catching up. Its AI models are shockingly advanced, and it recently unveiled a new photon chip that uses light instead of electricity. A competition like the Space-Race after 1958 with the USSR is upon us. Do we have no choice but to deficit spend like we did in the 1960s?

- The world is splitting into spheres of influence like in the 19th century. The U.S. could conceivably rule the Western Hemisphere, Russia in northern Asia, China and India asserting dominance in southern Asia. This could make commodities important assets within each sphere, as we are already seeing with China restricting critical minerals. Again, good for Canada if we can produce them.

Our Prediction

If we have to predict…our view is that 2026 should end higher, but it will be a bumpier road than previous years.

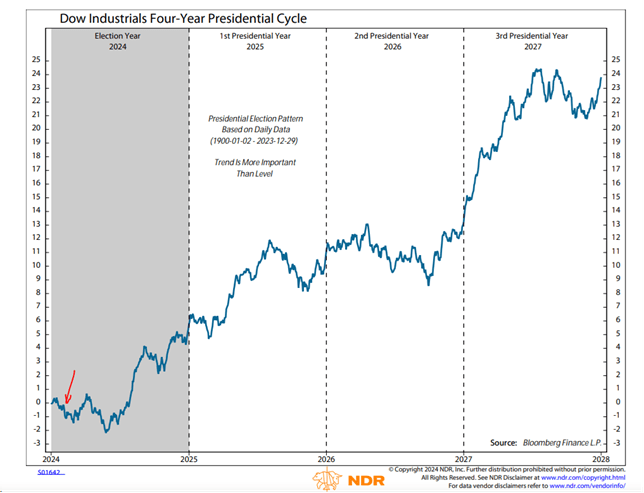

The second year of the Presidential Cycle – 2026 is the 2nd Presidential Year in this cycle - is often flat with a decline mid-year, followed by a year-end rally (this is based on 100 years of combined data).

How We React Determines Our Outcome

If anything, the current era is even more unpredictable than past ones. Who in 2025 predicted:

- the dramatic comeback of Canada’s Liberal government

- sweeping tariffs imposed on the world by the U.S. administration.

- the bombing of Iran’s nuclear facilities with no follow-on war

Few had these picked on their 2025 bingo cards.

2026 is starting out to be as geopolitically exciting as 2025. We have already seen Venezuela’s leader extracted and imprisoned, and Iran’s theocratic regime could be the next to fall. Both have enormous ramifications for oil supplies and the geopolitical balance.

What was the most important lesson from Raven and the MonkeyDex index?

The MonkeyDex index made 213% in 1999 and outperformed everyone. Luck and randomness led to overnight success

What matters more than predictions is how we react to unforeseen events. Some investors panicked and sold last April when tariffs were announced. Markets recovered quickly, leaving them behind.

In the movie Dodgeball, a struggling dodgeball team competes in a national tournament

U.S. Army photo

U.S. Army photo

They had no special strategy to win and instead focused on not getting hit.

Their five tenets of dodgeball survival were:

- dodge

- duck

- dip

- dive

- dodge (stated twice for emphasis)

By the end of 2002, the MonkeyDex had lost all its profits and vanished from the stock pages. Most of the professional managers who were beaten in 1999 fared much better, a result of human thought and discipline.

They dodged and ducked when the market fell. Yes, they declined, but much less than Raven’s portfolio did.

Our advice for 2026?

- When everyone loves one sector too much (AI? Gold?), it is probably time to take some profits.

- When they dislike and ignore sectors, it is probably time to consider buying.

- If markets panic, don’t.

Hotel Waikoloa

A question that came up recently is this:

“If AI searches are free, will the AI companies ever make money?”

The answer is yes, but maybe not the companies we see today.

The lesson from the hotel industry is instructive.

Back in the 1980s, when Japan was poised to take over the world, a sprawling mega-hotel was built on the big island of Hawaii. The Hyatt Regency Waikoloa opened in September 1988 with 1,240 rooms on 62 acres.

Amenities included Swiss-made air-conditioned trams and mahogany canal boats that delivered guests to their rooms, a lagoon with live dolphins that guests could swim with, and huge art galleries.

It cost $360 million to build – about $1 billion in today’s dollars

Hilton Waikoloa Village

The rumour at the time was that the hotel needed to rent every one of the 1,240 rooms at over $225 per night – about $750 in today’s dollars.

The Japanese economic bubble burst in 1991. When the Japanese tourists stopped travelling, the hotel struggled.

Even dolphins couldn’t pull in enough guests with pockets this deep, so when the Japanese miracle ended, the hotel fell into receivership. Hilton and another buyer stepped up in 1993 and bought the property from the banks.

By 2002, Hilton had had enough of its partner and acquired the whole thing at a 55% discount to the bankruptcy price.

And this was after a decade of cost-cutting. After taking full ownership, restaurants were closed, the art collection was liquidated in 2014, and an entire tower was turned into timeshares and sold in 2019 for about $100 million. In 2025, the canal boats were retired.

After three transactions – the original construction, the bankruptcy, the buyout by Hilton of its partner - the hotel is still in existence as a luxury resort.

Except now, it is finally profitable. (sources: Hilton annual reports, honoluluadvertiser, TripAdvisor)

The Third Owner…

Data centres being built today by the internet giants could cost up to $200 billion per year (source: wolfstreet).

If that sounds like a lot of money, it is.

To make their investment back, OpenAI, Alphabet, xAI, Oracle, and Anthropic will need to start charging a lot more for AI products and searches. Some may never see a profit and could be forced to sell their facilities at a loss.

The old saying in the hotel world is “the third owner makes the money.”

This may also end up applying to data centres.

Turn Up the Heat

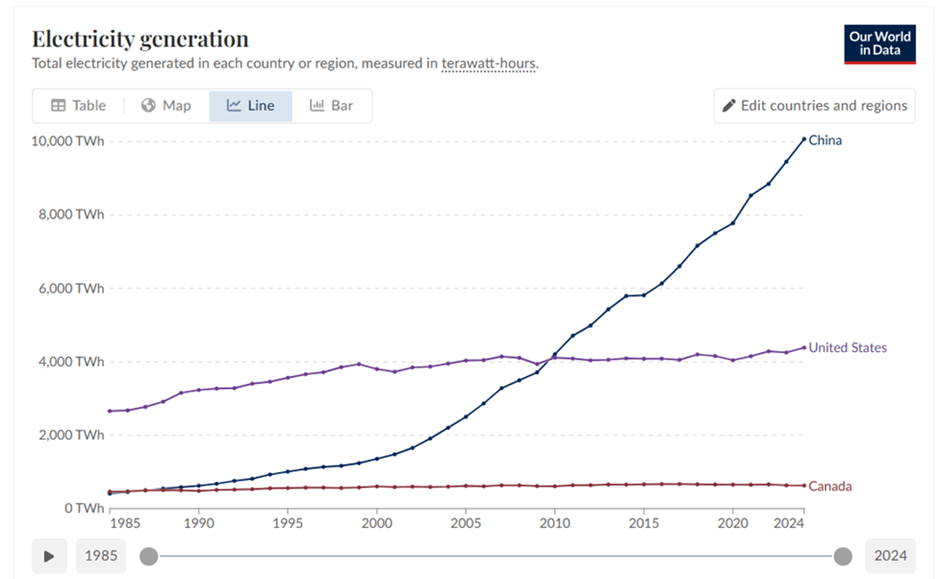

One part of the economy likely to see growth for multiple years is electricity generation.

Thanks to AI data centres and electric cars, we need far more electricity than we used to. China is way ahead of us in producing electricity, both from nuclear and traditional coal furnaces.

Canada and the U.S. have been flat for decades.

According to Bismark Briefs, if all planned data centres are completed, the U.S. will need almost 20% more power generation.

20% doesn’t sound like much, but it will require an enormous amount of everything - copper, cement, natural gas – to get there.

One Last Word on Energy

Finally, we saw Canada’s oil companies drop sharply in price last week when Venezuela’s leader was imprisoned. The fear was that Venezuelan oil was about to pour into the world, cratering prices.

Venezuelan oil is particularly thick, sticky, and full of sulfur. The pipelines and refineries needed to extract it have long since been pillaged for parts and scrap and so need complete replacing.

Canadian oil sands? Only US $33-52 breakeven cost per barrel, depending on how you extract it (steam assisted or mining). Our facilities are proven, paid for, and efficient.

It will be years before we see meaningful Venezuelan oil return. And it will take a lot of arm-twisting by the White House to convince energy majors to commit to investing in that country again.

Canadians can relax.

(offshore-technology.com, AI analysis)